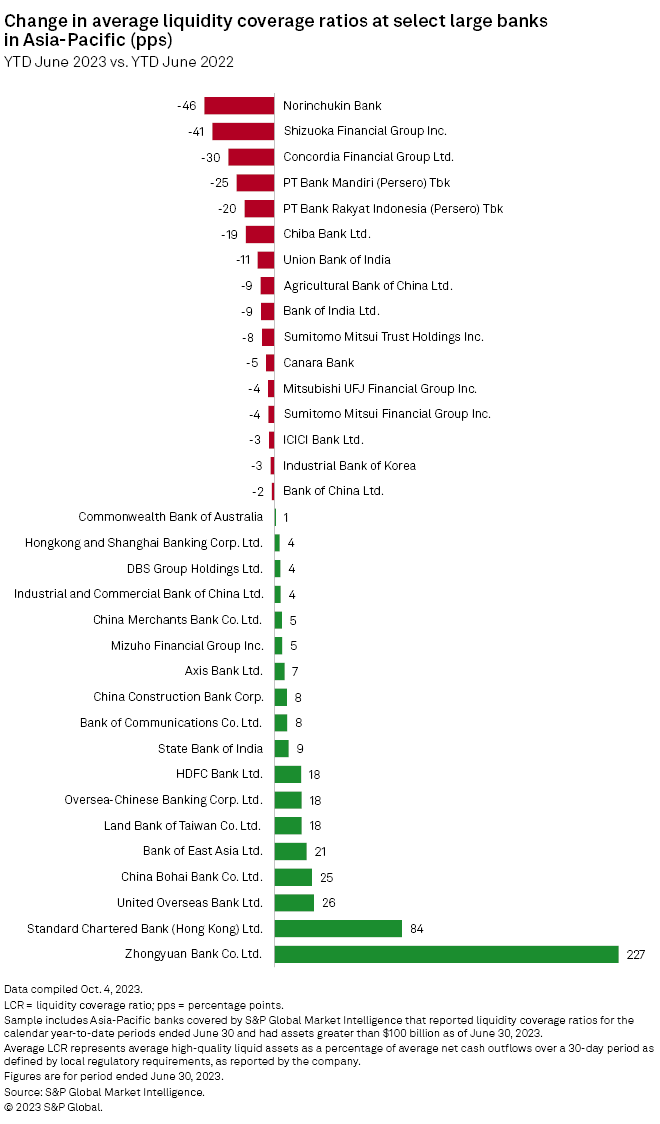

The liquidity coverage ratios of nearly all major Japanese banks fell on a year-over-year basis, reducing their ability to withstand a possible economic downturn.

Five Japanese banks were among the 10 lenders with the sharpest year-over-year fall in liquidity coverage ratios (LCRs) in the Asia-Pacific region as of June 30, according to data compiled by S&P Global Market Intelligence. The other five were made up of two from India, two from Indonesia and one from mainland China, the data showed. The sample includes regional banks with assets of more than $100 billion covered by Market Intelligence that reported LCRs for the calendar year-to-date period ended June 30.

The Norinchukin Bank's average LCR fell 46 percentage points year over year to 207.50%, the biggest fall among all major banks in the Asia-Pacific. The LCRs of Shizuoka Financial GroupInc. fell 41 percentage points, while those of Concordia Financial Group Ltd. fell 30 percentage points.

Liquid assets

Average LCR represents average high-quality liquid assets as a percentage of average net cash outflows over a 30-day period as defined by local regulatory requirements, as reported by the company. A high LCR shows that the bank has enough high-quality liquid assets to cover its expected cash outflows over the next 30 calendar days. As per Basel III requirements, banks must hold a minimum 100% ratio.

Even as Japan's central bank is expected to keep its ultraloose monetary policy through 2023, the economy is likely to stay weak. Japan's policy interest rate could see an increase of 0.1% in 2024 and about another 0.1% in 2025 from the current level of negative 0.1%, S&P Global Ratings said in an Oct. 13 report. The return to positive interest rates is unlikely to lead to any sharp deceleration in economic growth, the report said.

The Japanese yen dipped below the symbolic support level of 150 yen to the dollar on Oct. 20.

LCR gains

Some mainland Chinese banks increased their LCRs from a year ago. Zhongyuan Bank Co. Ltd. led the list with a 227-percentage-point increase year over year to 556.01%, followed by China Bohai Bank Co. Ltd. with a 25-percentage-point gain as on June 30.

India's two biggest lenders by assets also posted gains. State Bank of India's LCR rose 9 percentage points and that of HDFC Bank Ltd. increased by 18 percentage points. Hong Kong's Standard Chartered Bank (Hong Kong) Ltd. saw an 84-percentage-point gain in its LCR to 225% as on June 30.

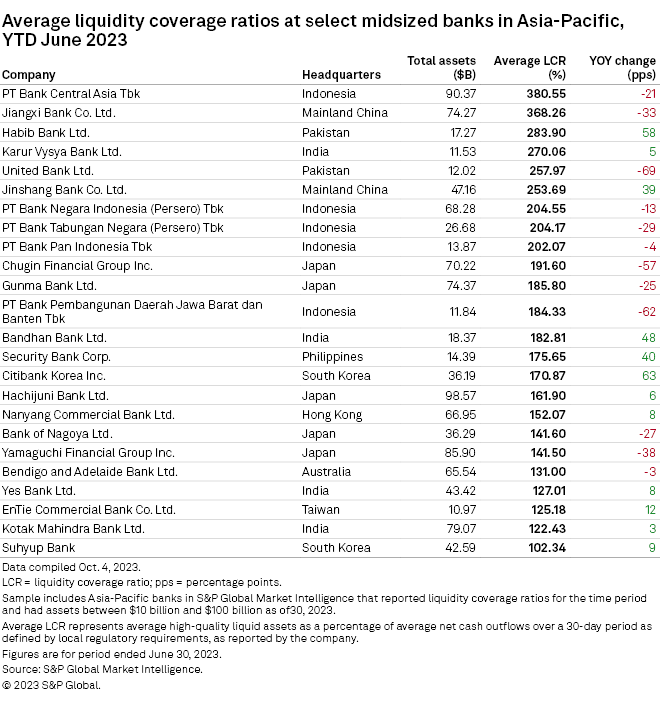

Several midsized Japanese banks with $10 billion to $100 billion in assets also registered sharp falls in their average LCRs, even among midsize banks in the same asset value range, according to Market Intelligence data. Chugin Financial Group Inc.'s LCR fell 57 percentage points, and Yamaguchi Financial Group Inc. posted a 38-percentage-point decline.

As of Oct. 23, US$1 was equivalent to ¥149.81.