U.S. states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use as well as use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.

All figures listed are based on aggregations and weighted averages of as-reported numbers filed in the rate filings of each subsidiary in each state. The overall rate impact is calculated based on the aggregated written premium change from all rate filings during the period as a percentage of the largest written premium submitted by each filer in the group in every state. The overall rate impact for each group, in some states, may be higher or lower than each approved change in the period.

The calculated premium change is not a final projection of the additional premium the insurer may receive in the upcoming year. The calculated premium change is reported by each insurer to reflect the most impactful premium changes based on the combined impact of the percentage change and the amount of business it affects. Changes to the insurer's policy mix or policies-in-force are not factored into the analysis.

Liberty Mutual Holding Co. Inc. stands to see the biggest premium gains from homeowners insurance rate increases approved during the second half of 2022.

The aggregate calculated premium change from all approved filings totaled $729.8 million, according to an S&P Global Market Intelligence analysis, much greater than any of its peers.

Farmers Insurance Group of Cos. came in second among the five largest homeowners insurers, with its subsidiaries expected to see additional written premiums of more than $575 million across 42 states.

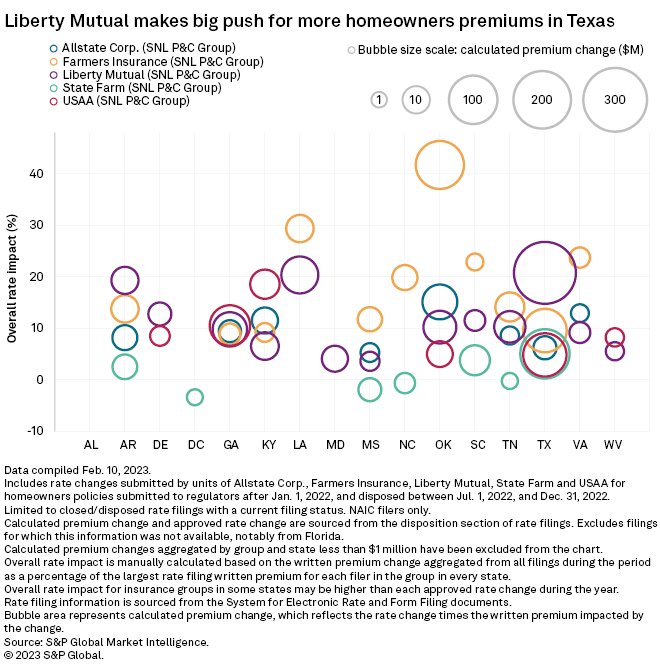

Texas grants significant rate hikes

The most impactful homeowners rate increases during the back half of 2022 were in Texas. Regulators in the Lone Star state granted increases effectively raising Liberty Mutual's rates by 20.8%.

Liberty Mutual, the third-largest homeowners insurance underwriter in the U.S., also received approval to raise rates in a dozen other Southern states. The effective rate increase exceeded 10% in six of those states. In total, the insurer may see premiums rise $408.4 million in the region, based on a constant customer base.

All of Liberty Mutual's largest competitors also raised homeowners rates in Texas. Farmers raised its rates by 9.6% there, while United Services Automobile Association, State Farm Mutual Auto Insurance Co. and The Allstate Corp. boosted their rates by 4.9%, 5.1%, 6.2%, respectively.

Outside of Texas, the most notable increase in the South during the period was in Oklahoma. Through 11 filings with the state regulator, Farmers will raise its homeowners rates overall by 41.7% across its book of business in Oklahoma.

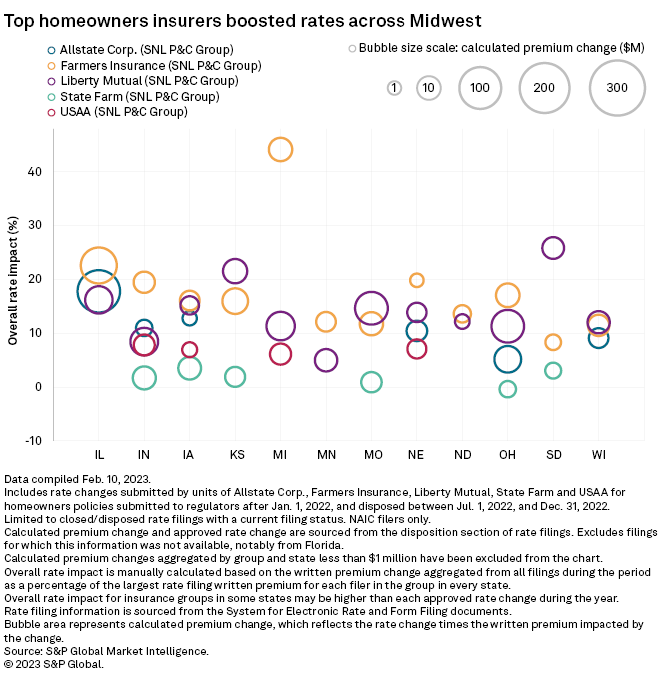

Illinois surge

Allstate is expected to see the most impactful increase in the Midwest. Its overall rate increase of 17.8% in Illinois should push calculated premiums up $104.6 million based on the current book of business. Liberty Mutual and Farmers raised rates in the Prairie State by 16.2% and 22.6%, respectively.

* Download a template that analyzes rate changes for selected entities, state or type of insurance over a selected time period using interpretive charts and histogram.

* Read an article about Florida residential insurance.

* Read about insurance companies placed in rehabilitation or liquidation.

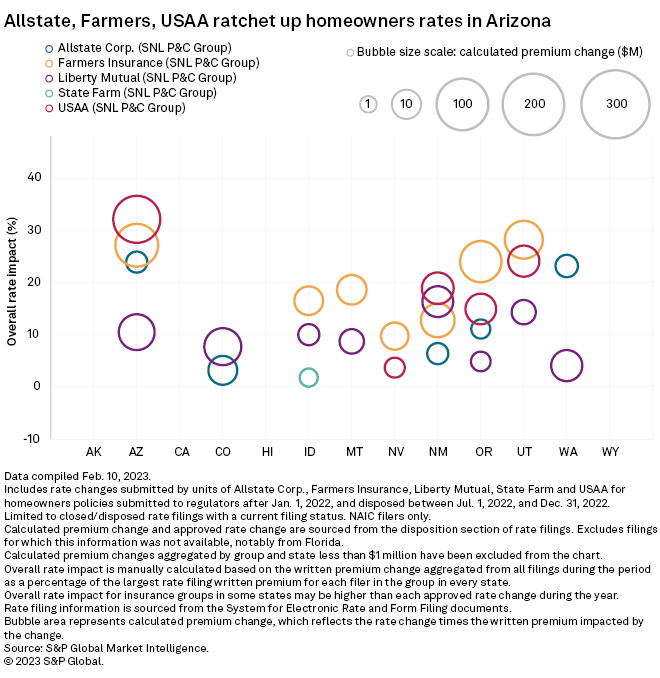

USAA's rate hikes out West

USAA received approval to raise homeowners rates in several Western states during the second half of 2022, with the most significant change occurring in Arizona. Its overall rate increase of 32.1%, the biggest increase for any insurer in this analysis, resulted in a calculated premium change of $68.1 million in the Grand Canyon State. The insurer also boosted rates in Nevada, New Mexico, Oregon, Utah and Washington in the period.

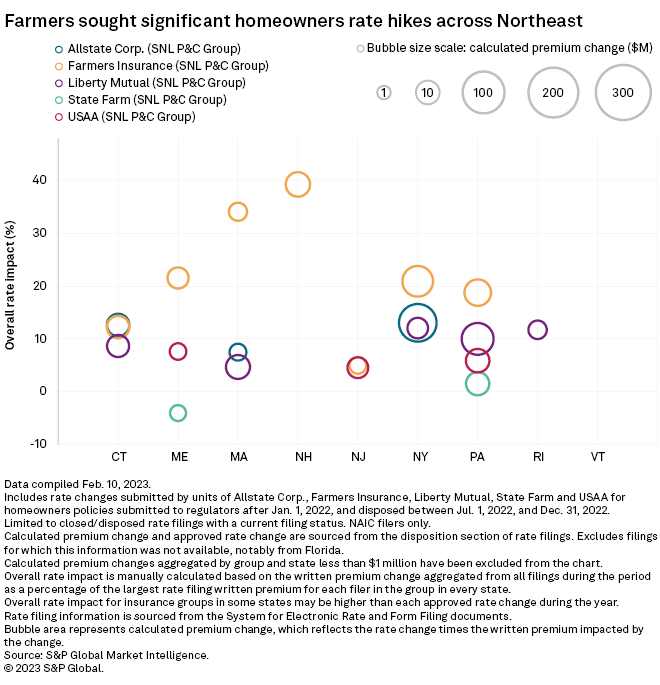

Farmers pushes rates up across Northeast

Farmers received approval to raise homeowners rates in every Northeastern state, with five states seeing increases in excess of 20%.

Liberty Mutual also received approval for rate increases of between 8% and 12% in four states.