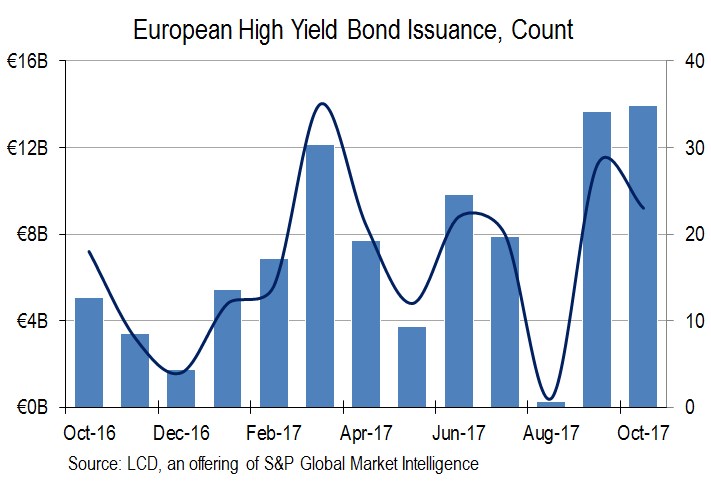

High-yield activity in Euroepe was rampant in October, which hosted a record volume for the second-consecutive month, and also helped the market rack up a record annual supply total.

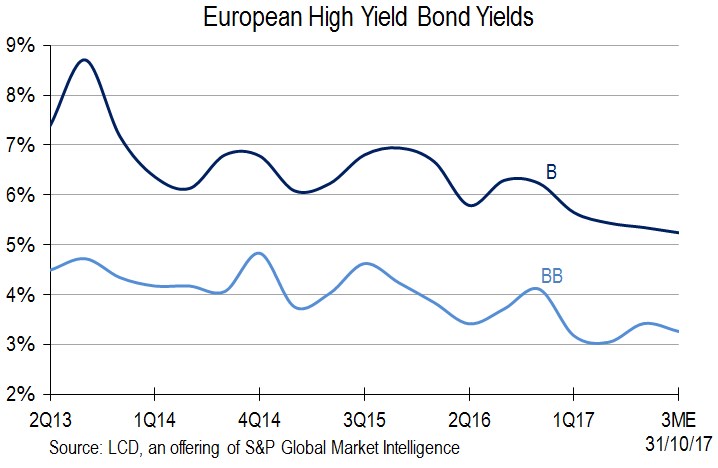

The asset class remained highly issuer-friendly too, as credits — often with chequered pasts or from difficult sectors — locked in low yields, while a high proportion of deals printed at the tight end or tighter than guidance, often with upsizes, and new issues on average performed better on the break than they have done all year.

Despite the low yields on offer, from the buyside’s perspective such players need to get invested and are awash with cash.

“There is simply so much money out there, and this continues to drive high levels of supply,” says a head of syndicate. “It’s very hot right now. Even after September when we thought all that supply might cause the market to back up a little, it didn’t. Then in October, whenever we tightened pricing, we weren’t seeing orders drop out.”

“This is the most technically imbalanced market I have seen in years,” notes another head of syndicate. “Inflows, money coming from non-traditional high-yield, coupon accrual, bond redemptions, and rising stars are all coming together to create this massive demand for paper.”

Not only are issuers locking in such tight yields, but they are also seeing deals fly though syndication. A staggering 10 bonds priced tighter than guidance in October — up from nine last month, and the largest number ever, according to LCD. And for the second month running, roughly 94% of bonds came tighter than or at the tight end of initial guidance, just below the 95% seen in September, which was the largest monthly market share since May 2017.

Looking ahead, bankers remain highly constructive, commenting that October’s swathe of excellent executions highlights that low yields and high risk appetite has led more issuers to put their hand up to come to market. Meanwhile, even the buyside — for all its dislike of falling new-issue yields, and a secondary market offering investors little value — can take heart from the roughly 6.5% returns generated by the asset class this year, and such players are aware that the increased risk requires greater skill in stock-picking. Moreover, even high-yield’s meagre yields are more than cash offers. — Luke Millar

Try LCD for Free! News, analysis, data

This story was excerpted from a full analysis on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.