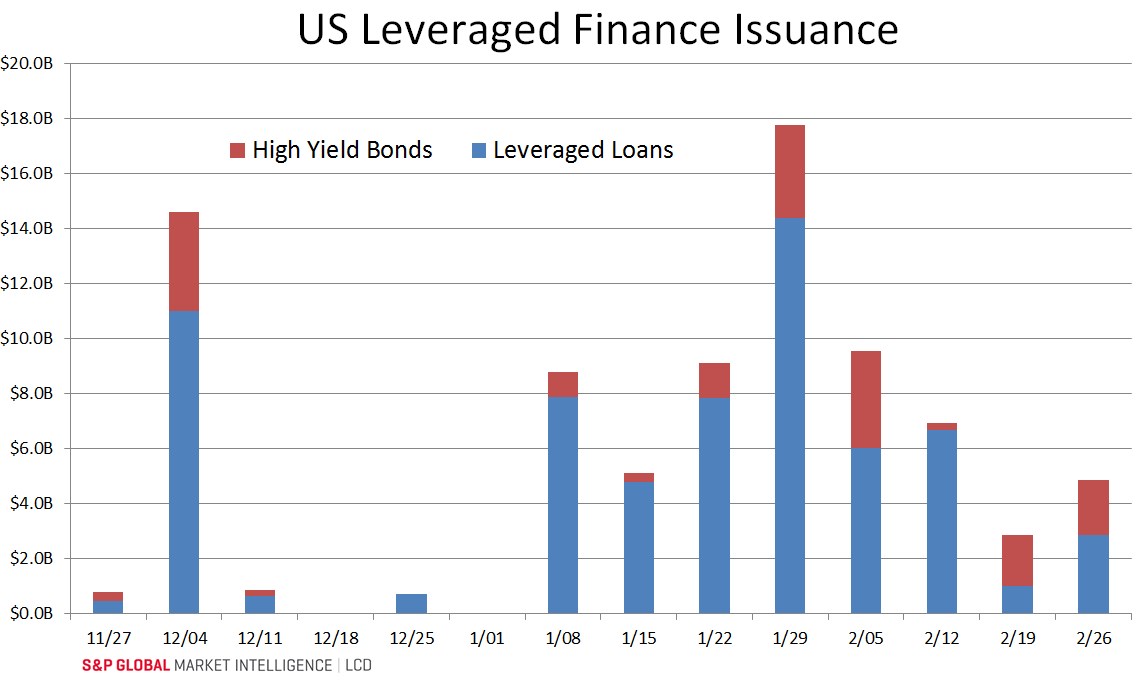

The U.S. leveraged loan and high yield bond markets continued their respective new-issue struggles last week, with a combined $4.9 billion in deals, according to S&P Global Market Intelligence LCD.

While that number is up from the previous week, it’s the second-lightest week of the year, issuance-wise, as both asset classes continue to focus on deals already in market – like Solera – and as investors continue to tread lightly around all things risk.

Year to date, the U.S. high yield bond market has seen $13.65 billion in issuance. That’s down a whopping 75% from the same period in 2015.

On the face of it, leveraged loans have fared better, with $51.3 billion in issuance so far this year, down some 5% from the same period in 2015. Though the asset class, of course, has been hurt by investor withdrawals and limited CLO issuance. – Staff reports

Check out LCD News on Twitter, or on our full website.