In this month’s Capital Markets View video, LCD’s Taron Wade and S&P Global’s Chris Porter do their first quarterly comparison of the U.S. and European markets. (This will be an ongoing quarterly feature of the video.)

Discussed this month:

- The first quarter of 2018 was a strong one for loan volume in Europe, matching the 1Q17 tally, though the U.S. supply was down a little from last year’s record effort.

- The long-promised uptick in M&A volume has finally arrived, driven in part by activist investors pushing for corporate disposals.

- European repricing volume was lower in the first quarter than in 4Q17, though such supply remains strong in the U.S. This can be explained by divergence between the regions’ interest-rate environments.

- On a rolling three-month measure, the all-in yield to maturity (for TLBs rated B) was much higher in the U.S. than in Europe, at 5.66% versus 4.17%, respectively.

- Weighted average spreads are closer between the two regions, though they’ve headed up in Europe and down in the U.S., which helps explain the repricing dynamic (see above).

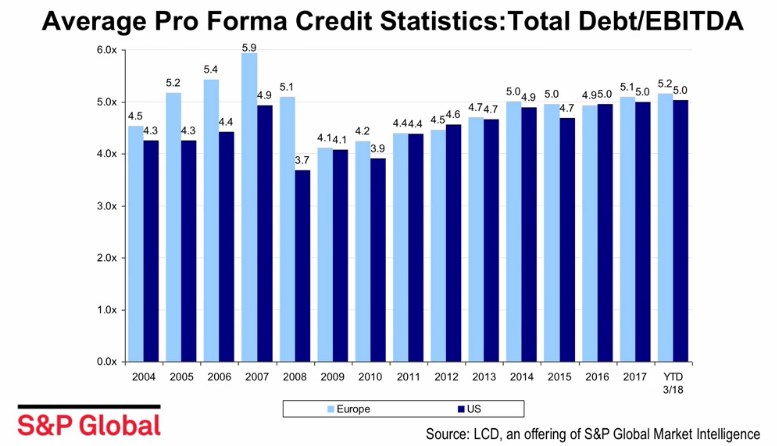

- There is also divergence in some credit metrics, with the total-debt-to-EBITDA multiple slightly higher in Europe than it is stateside, while the former region also hosted less senior debt as a share of overall volume in 1Q18 than previous periods.

- Total cross-border volume was higher in 1Q18 than the year-ago period, despite such supply hitting a record in 2017.

- The CLO market enjoyed a very strong first quarter on both sides of the pond, supported by strong demand, and could see some new managers emerge this year.

- The URL for the video: https://www.spratings.com/en_US/video/-/render/video-detail/capital-markets-view-april-2018

Taron Wade heads up LCD’s European Research efforts. Chris Porter is Head of Loan Recovery & CLO Business Development, S&P Global.

As ever, please feel free to contact Taron or Chris if you’d like a particular topic discussed in next month’s video.

Try LCD for Free! News, analysis, data

LCD comps is an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.