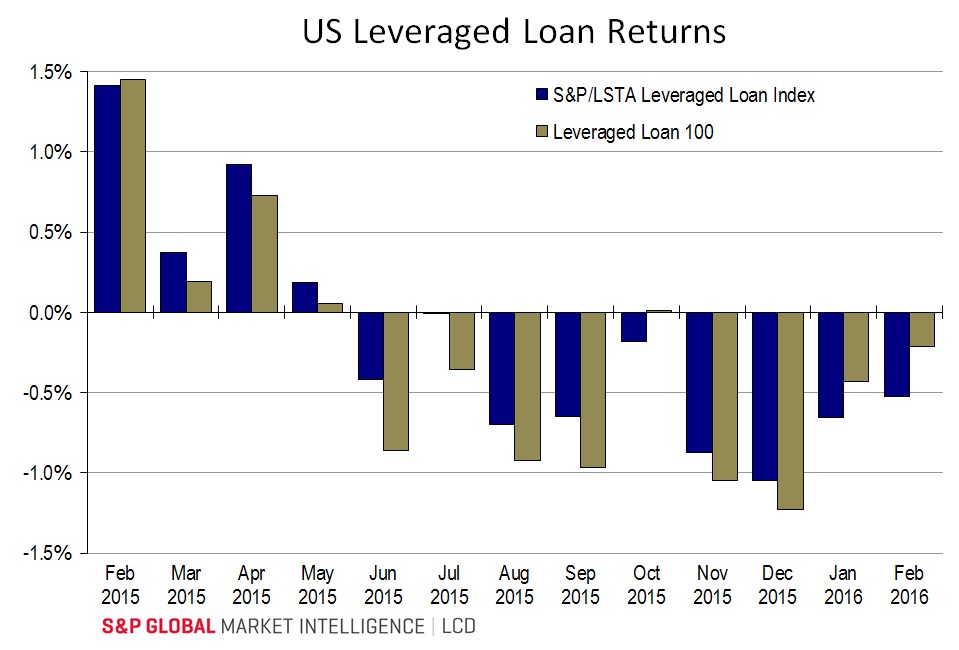

Despite a rally in the final week of the month, the S&P/LSTA Index still shed 0.53% in February, after dropping 0.65% in January.

The largest loans, which constitute the S&P/LSTA Loan 100, continued to outperform in February, falling a more modest 0.21%, after losing 0.43% in January.

February’s loss extends the asset class’s run of red ink to a record nine months, topping the prior record of six months, from the second half of 2008. The losing streak is a product of (1) generally weak technical conditions, (2) negative investor sentiment across the capital markets, and (3) growing concerns about the state of the credit cycle. – Steve Miller

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.