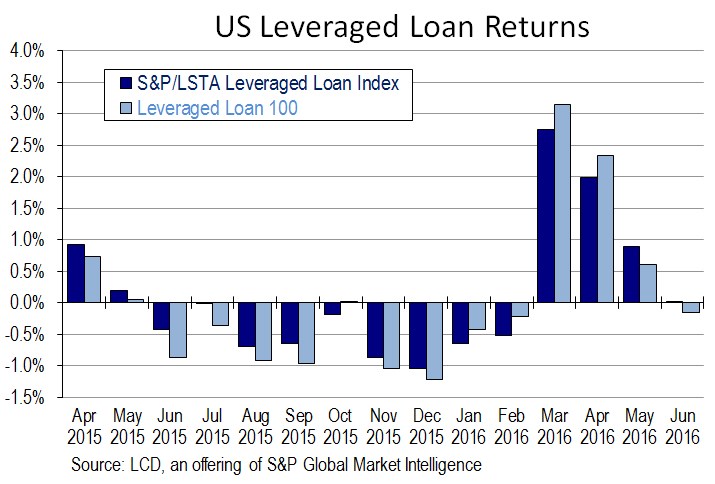

After some ups and downs, the S&P/LSTA Leveraged Loan Index managed to eke out a positive return in June, gaining 0.02%. The largest loans, which compose the S&P/LSTA Leveraged Loan 100 Index, were down slightly for the month, returning negative 0.15%.

In the year to date, index returns are 4.51%, little changed from the end of May but up significantly from 2.83% during the same period last year. The LL100 has returned 5.36% in the year to date, versus 1.76% through the first half of 2015. –Kerry Kantin

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.