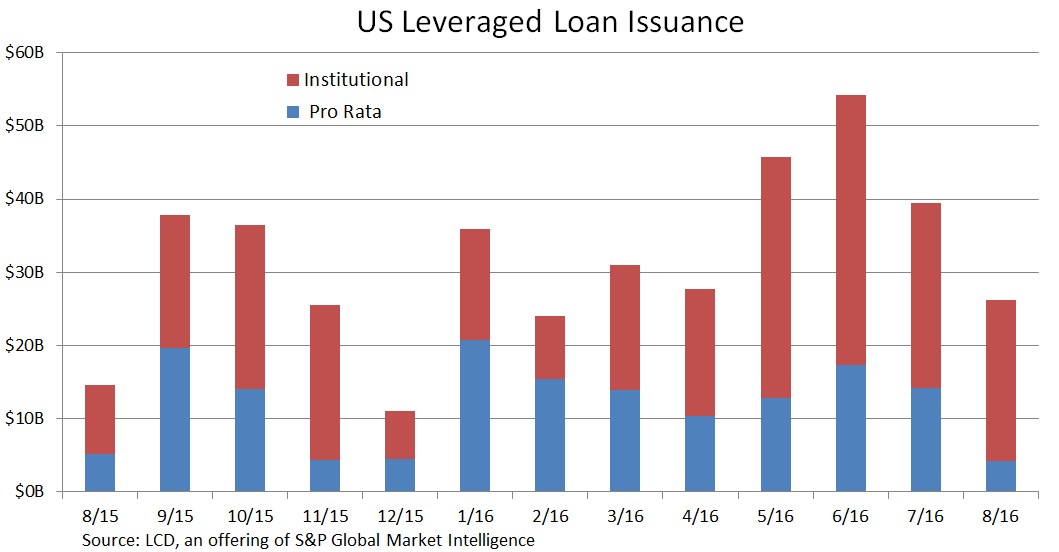

Leveraged loan issuance in the U.S. totaled $26.2 billion in August, down from the $39.4 billion seen in July, according to LCD.

As with other financial markets, August is usually a quiet time for leveraged loans, and last month was no exception, as it was the slowest month volume-wise since the $11.1 billion seen in December 2015. Issuance last month was up from the year-ago period, however.

Through August, 2016 leveraged loan issuance totals $283 billion, down roughly 9% from the $312 billion during the same period in 2015. – Staff reports

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.