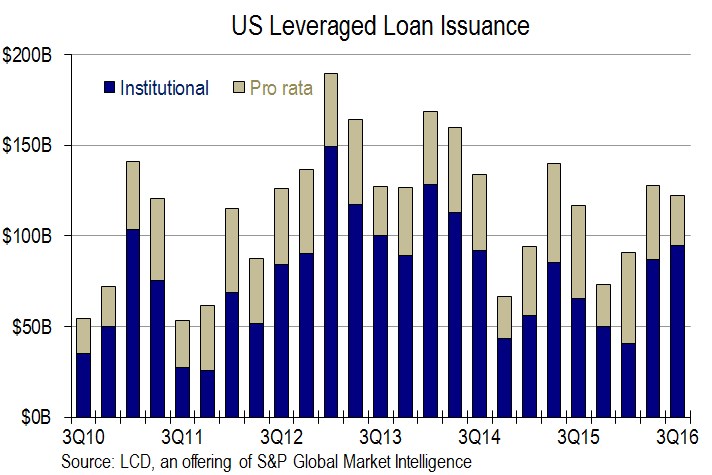

There was $122.3 billion in leveraged loan volume during 2016’s third quarter, down slightly from the $127 billion in the second quarter, according to LCD.

Institutional issuance increased to $94.5 billion, from $87.2 billion, while pro rata activity – the portion of loans syndicated to traditional bank investors – dropped noticeably, to $27.8 billion in the third quarter from $40.5 billion in the second.

YTD, that’s $222 billion institutional (vs $207 billion YTD 2015) and $119 billion pro rata (vs $143 billion). These numbers are preliminary, and could change slightly by quarter-end proper.

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.