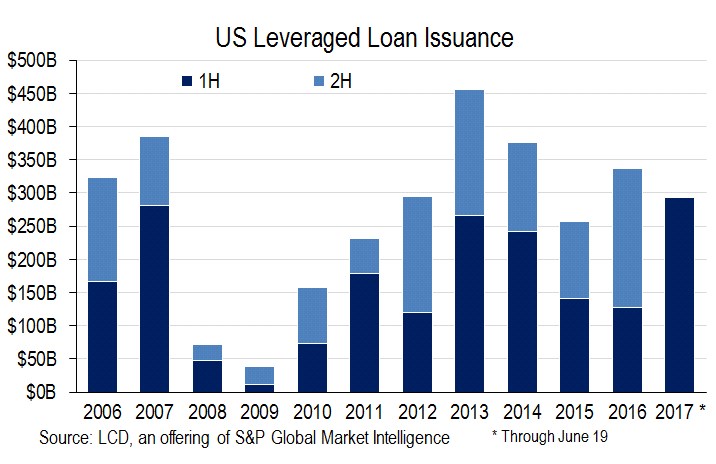

Bolstered by an unyielding flow of investor cash into the asset class, U.S. leveraged loan issuance hit a dizzying $294 billion in 2017’s first half, according to LCD. That’s the most ever, including the go-go period of 2007 – the previous first-half record – right before the financial crisis.

The first six months of this year was an issuer’s market, to be sure, as borrowers made repeated runs at an unswervingly accommodating investor base, which has spent what seems like forever in an exhausting, frustrating search for yield (it’s been the better part of three quarters, actually).

Indeed, demand for loan paper was so intense this year that repricing activity – where an issuer simply returns to market to obtain more favorable borrowing costs on an existing credit, as opposed to undertaking a new loan agreement proper – hit a surreal $346 billion in the first half, dwarfing activity in prior periods.

(To illustrate just how voracious investor appetite was during the first six months of 2017, the bulk of the repricing activity is not included in the above chart, as it did not entail a syndications process proper).

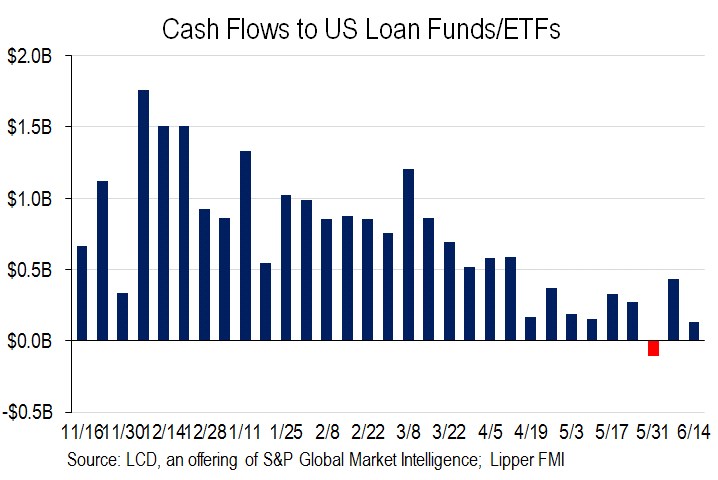

Why was the U.S. market so busy? Because of anticipation of interest rate hikes, institutional investors continued to pour money into the asset class; there has been a roughly $14.4 billion net inflow so far this year, according to Lipper.

A floating rate asset class such as leveraged loans tends to attract investors when the outlook is for a rising rate environment (as the interest rate on loans rises and falls, along with LIBOR).

Those cash inflows are starting to ease, finally – indeed, there were even net outflows recently – as a third Fed rate hike in 2017 looks less like a sure bet and as inflation indicators waver a bit (floating rate asset classes also thrive amid expectations of inflation). – Tim Cross

Try LCD for Free! News, analysis, data

This story is taken from analysis which first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.