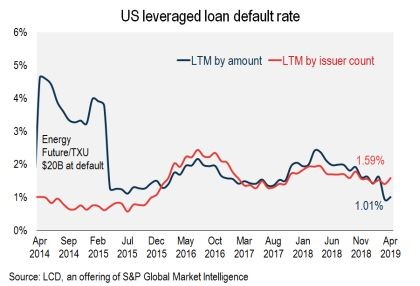

The U.S. leveraged loan default rate closed out April at a slight 1.01%, barely moving from a nearly seven-year low of 0.93% in March, according to the S&P/LSTA Loan Index.

As it has for the past few years, the leveraged loan default rate is well below the historical average of 2.93%. Loan defaults have been relatively few and far between in the current long-running credit cycle, largely for two reasons.

First, corporate earnings continue strong, meaning borrowers are well positioned to service debt costs. Second, speculative-grade lenders and investors have been most accommodating, allowing debt issuers to incur loosely structured credits (aka covenant-lite loans), which might not trigger events of distress or default that otherwise could warn lenders of impending problems.

In April, the addition of three defaulters, while only adding eight basis points to the default rate by amount, pushed the rate by issuer count to a six-month high of 1.59%, reflecting the outsized influence of $6.3 billion of Clear Channel term loans that rolled off the calculation in March, according to LCD.

Try LCD for Free! News, analysis, and data.

Follow LCD on Twitter.

LCD comps is an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis, and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.