In September, for the second month running, there were no new defaults among issuers in the S&P/LSTA Leveraged Loan Index.

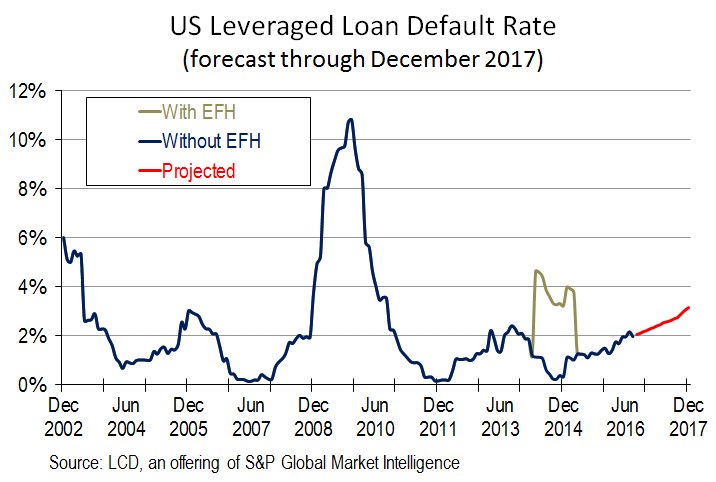

As a result, the lagging U.S. 12-month loan default rate eased to a five-month low of 1.95% by principal amount, from 1.98% the previous month and a from 16-month high of 2.17% in July, according to LCD.

Looking ahead, despite the relatively quiet summer, U.S. loan managers expect the leveraged loan default rate to trend higher over the next 12 months as the market nears the latter innings of the current credit cycle.

According to LCD’s latest quarterly buyside survey, conducted in September, participants expect the default rate by principal amount to climb from August’s reading of 1.98% to 2.77% by the end of September 2017, before pushing higher to 3.16% by year-end 2017. (The full default analysis/survey is available to LCD subscribers.)

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.