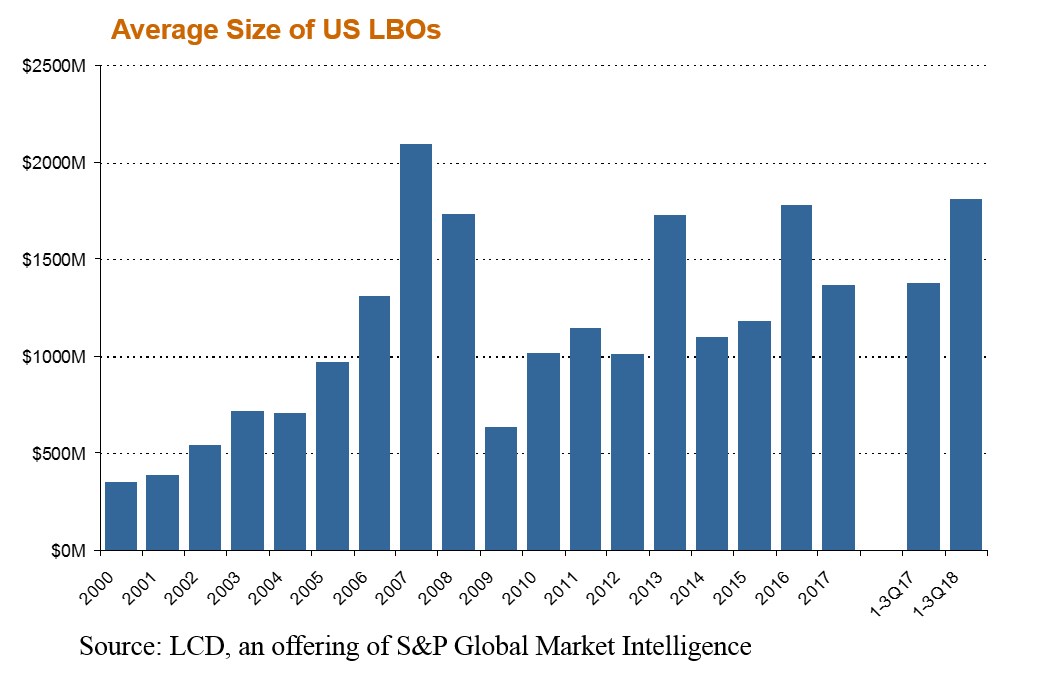

Thanks to a spate of big-ticket deals in September, leveraged buyouts in the U.S. are larger now than at any time since the financial crisis.

During the third quarter the average size of an LBO transaction hit $1.8 billion, according to LCD. That’s up from $1.375 billion during the same period a year ago and is near the record $2 billion average in 2007, at the height of the last credit cycle.

Boosting the 3Q18 numbers are some jumbo LBOs, two of which entail large cross-border leveraged loan components. Chief here is the $17 billion majority buyout of Thomson Reuters’s Financial & Risk unit, now called Refinitiv (link, plus a list of the largest leveraged financings of all time). As well, Carlyle and GIC recently closed financing on their $11.7 billion LBO of Akzo Nobel Specialty Chemicals.