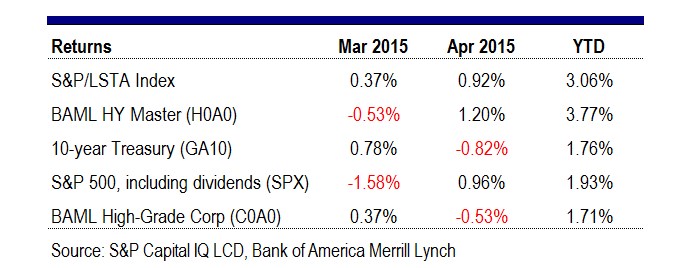

After selling off in late 2014, leveraged loans have bounced back in early 2015. The Index is up 3.06% through April, its best gain for the first four months of a year since 2012, when it was up 4.53%. Of the five asset classes tracked by LCD, leveraged loans in 2015 trail only high yield bonds, and trailed only HY and equities (slightly) in April. – Steve Miller

Follow Steve on Twitter for leveraged loan news and insight.

This analysis is part of a longer news story, available to LCD News subscribers here, that also details

- Monthly loan returns

- Annual loan returns

- Returns by rating

- Oil & Gas loan returns

- Performing loan incidence

- Repricing volume

- Loans outstanding: volume

- Loan forward calendar

- Big movers – April