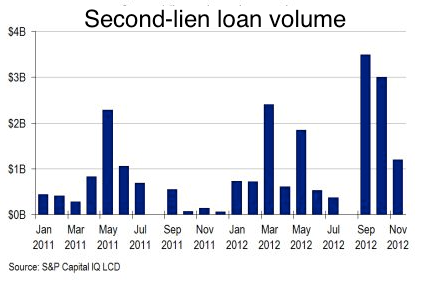

Bolstered by strong loan demand from relative-value investors – at least before the recent setback in stocks – second-lien loan volume is running at multi-year highs.

Of course, second-lien debt is a niche product for issuers that require higher leverage than is usually available in the first-lien market, but that in many cases are locked out of the regular-way high-yield bond market because of size, credit quality, or complexity. Understandably then, the issuer base for 2012-model second-lien loans is dominated by (1) loans with CCC facility ratings (mainly from issuers with a single-B corporate-rating profile) and (2) unrated middle-market paper.

Niche product or not, second-liens are on a tear. Indeed, between Sept. 1 and Nov. 16 arrangers launched $7.7 billion of such loans, the largest three-month total since June to August 2007.

This chart is part of a longer LCD News story, available to subscribers here. It includes:

- Second-lien loan volume by year

- Second-lien outstandings/institutional outstandings

- Second-lien loan volume, by rating (rare LCD pie chart)

- Leverage: second-lien loans

- New-issue yields, second-lien loans