It was risk-off in the U.S. leveraged loan market during 2016’s first quarter – for LBOs with ultra-high debt, anyway – as more restrictive lending regulations and unfriendly market technicals kept a lid on aggressive buyout deals.

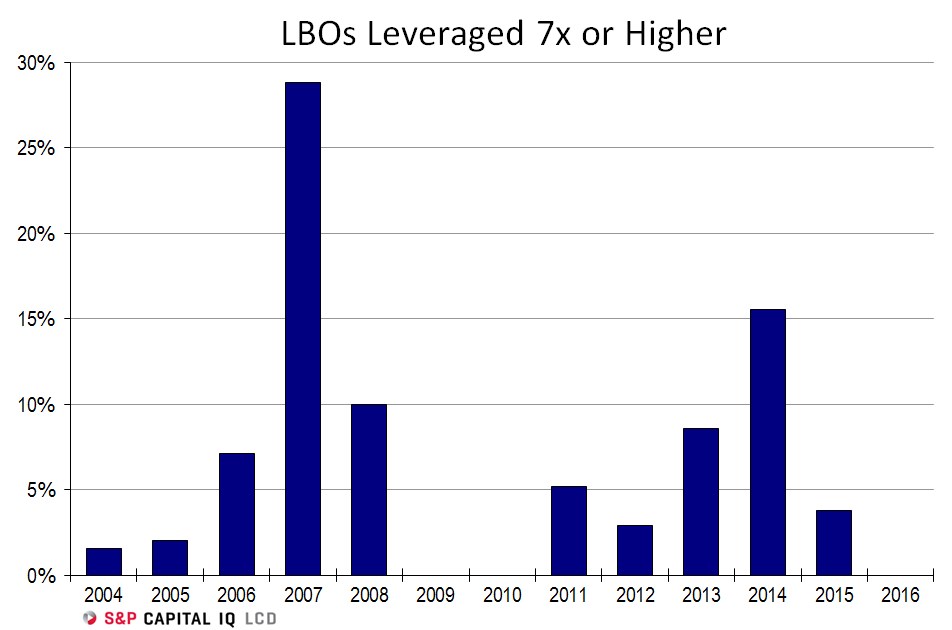

So far this year there have been no LBOs structured with a debt multiple of 7x or more, according to S&P Global Market Intelligence LCD.

In comparison, roughly 4% of LBOs completed in 2015 featured leverage starting at 7x or more, while 15.5% of LBOs had that debt structure in 2014. (That’s the most since the market collapse of 2008/09.) – Staff reports

This analysis – along with a host of other charts and tables – first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.