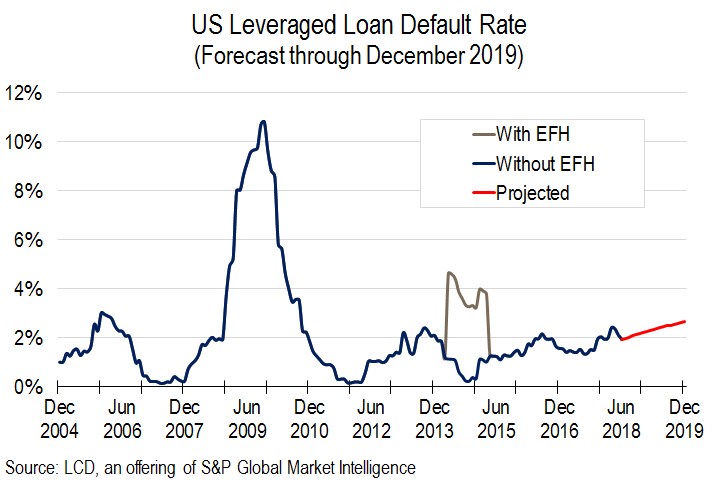

Portfolio managers of U.S. leveraged loans expect default activity to continue its modest ascent over the next 18 months, with the long-anticipated spike above historical averages materializing in 2020, according to LCD’s latest buyside poll.

On average, managers predict the one-year-forward default rate of the S&P/LSTA Index to finish June 2019 at 2.46%, up slightly from the previous one-year-forward prediction of 2.43% polled in March, versus the current default rate by amount of 1.95%.

Managers, in the near term, say they continue to see idiosyncratic risk as the main driver of loan defaults, rather than a broad-based uptick at a systemic level.

Conducted in June before the end of the second quarter, LCD’s Default Survey also asked portfolio managers their predictions on the loan default rate at the end of 2019. The consensus estimate was 2.65% by then, a slightly more bullish read this time around, with managers reining in the forecast from 2.81% at the March reading (but keeping it close to their 2.64% prediction from December).

Historically, U.S. leveraged loan defaults have averaged roughly 3.1%.

The default rate has been of particular scrutiny over the past year or so for two important reasons. First, the current, borrower-friendly credit cycle is approaching its 10th year, an unusually long stretch. And, related, with the ubiquitousness of loosely structured covenant-lite loans in today’s market, many observers are concerned that, once the credit cycle does turn, defaults could pile up quickly, as traditional protections for lenders/investors – a set of covenants – no longer are routinely structured into loan agreements. – Rachelle Kakouris