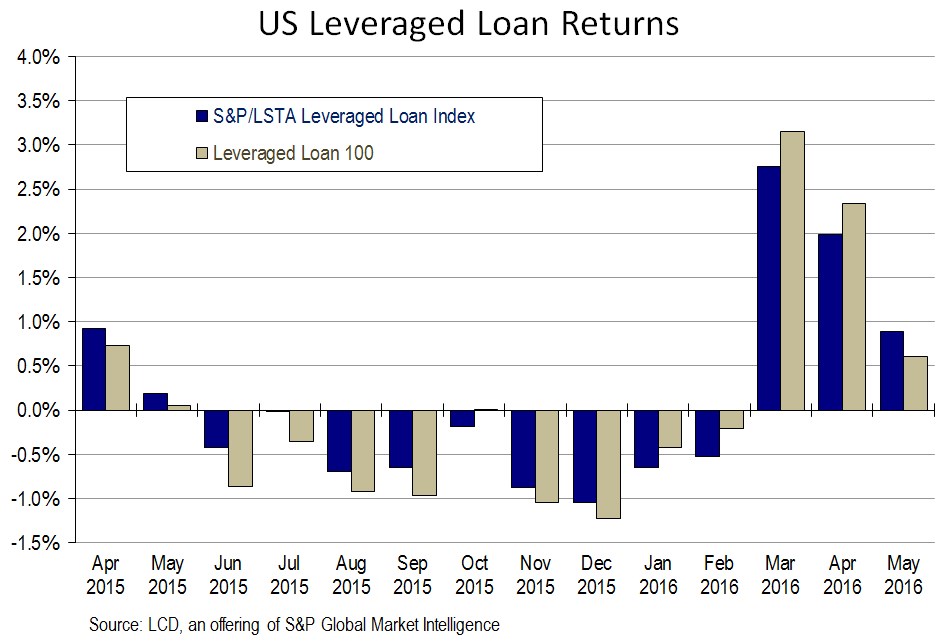

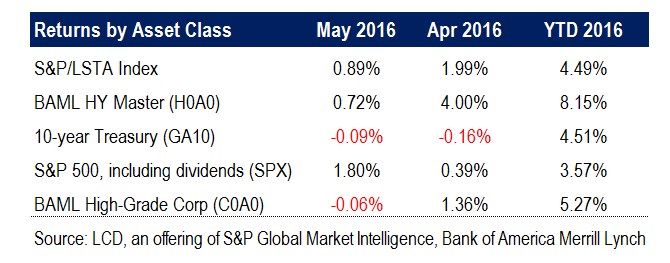

With lopsided market technicals generating another month of firm conditions, the S&P/LSTA Leveraged Loan Index recorded its third consecutive monthly gain in May, returning 0.89%.

Last month’s increase, though more modest than those posted in April and March, nevertheless pushes Index returns further into the black in 2016. The broader Index has returned 4.49% in the year to date.

Even though gains were more modest than in April or March, loans outperformed all of the asset classes LCD tracks for this analysis, aside from equities. For the year-to-date, however, high yield continues to lead the pack, easily. – Kerry Kantin

![]() Follow LCD News on Twitter

Follow LCD News on Twitter

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.