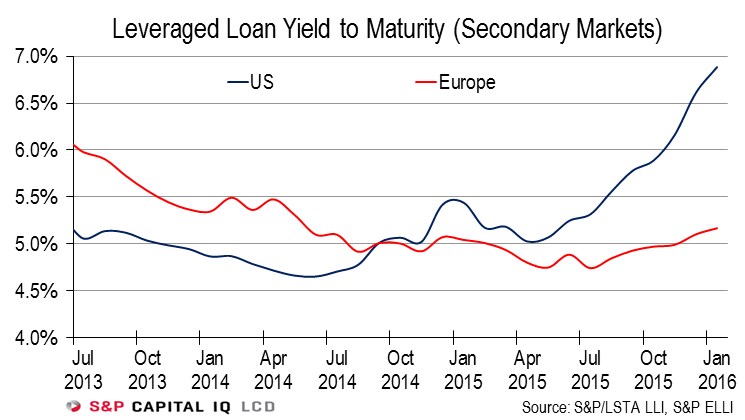

The yield differential between the U.S. and European leveraged loan markets continues to widen as the U.S. is hit by growing concerns about the credit cycle, as well as exposure to sectors under pressure (energy).

For the week ended Jan. 29, the discounted yield to maturity on the S&P/LSTA Leveraged Loan Index reached 6.88%, versus 5.17% on the S&P European Leveraged Loan Index (ELLI) – a 172 bps difference. At the end of December the differential was 151 bps, and at the end of November it was 117 bps.

Although secondary yields have started to rise slightly at the start of this year in Europe, the loan market on this side of the Pond remains relatively isolated from the broad volatility that hit secondary bonds, and which resulted in a near-silent high-yield bond primary during January. – Isabell Witt

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.