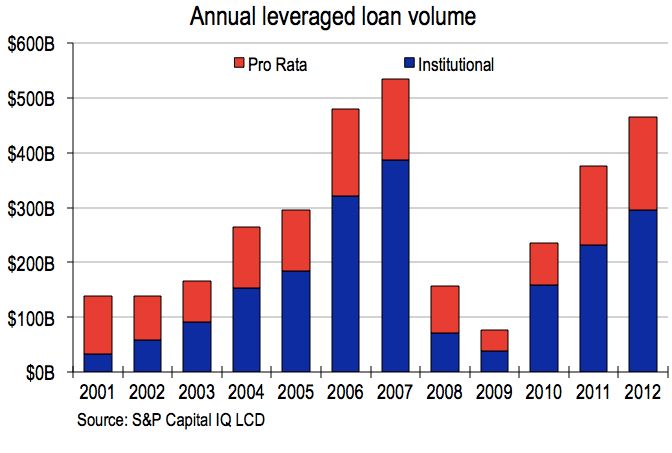

U.S issuers printed $465 billion of new leveraged loans in 2012, 24% more than in 2011, when $375 billion in deals crossed the goal line. That’s the third-biggest year of primary loan production, behind 2006 and 2007.

The market has been especially hot in the fourth quarter, amid a largely stable macro environment and demand-rich technical conditions. All told, new-issue loan volume climbed to $136 billion during the final three months of 2012 – the most since the first quarter of 2011, when quarterly activity reached a post-credit-crunch high of $141 billion – from $126 billion in the third quarter.

LCD’s full leveraged loan volume numbers will be published for subscribers later today. In that story we’ll detail

- Quarterly volume – total

- Quarterly volume – institutional

- Leveraged finance volume (loans + high yield bonds)

- Loan performance in trading market