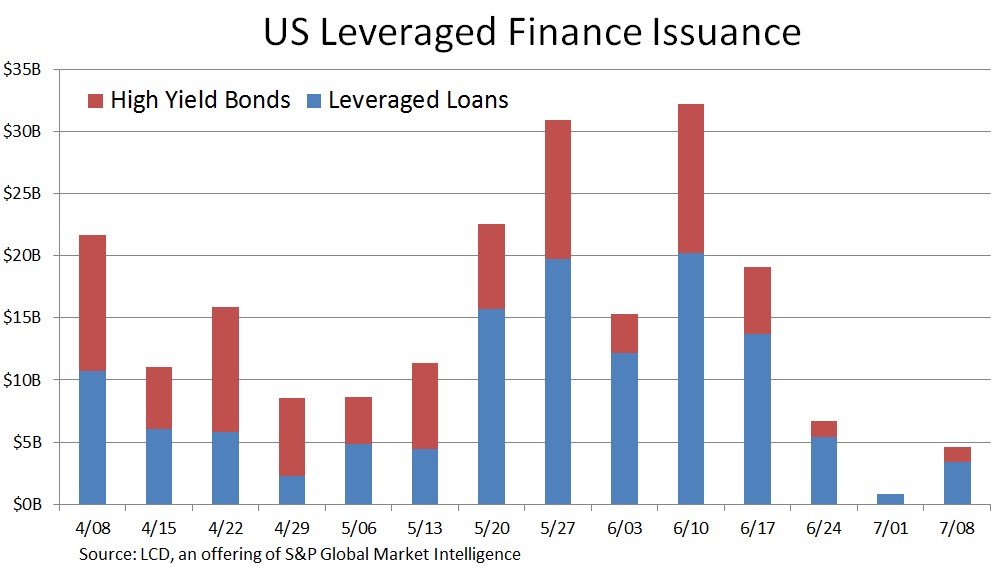

The U.S. leveraged finance segment was quiet last week as market players worked around the July 4 holiday and began to navigate the post-Brexit vote landscape.

After posting no issuance the previous week there was $1.3 billion in high yield bond deals last week, most notably via Transocean Offshore, a fallen-angel issuer which launched a $1.25 billion offering to refinancing existing debt.

Year to date, U.S. high yield bond issuance totals $120 billion, down from $186 billion at this point in 2015, according to LCD, an offering of S&P Global Market Intelligence.

Despite no deal flow, there was news in the market. Institutional investors poured a hefty $1.8 billion into high yield funds last week, ending three weeks of withdrawals totaling $4.2 billion, according to Lipper.

The leveraged loan space was more active, though still unimpressive, with $3.4 billion in deals last week, after posting a scant $800 million the previous week. Of note, Realogy, the parent company of Century 21, ERA, Coldwell Banker, and Sotheby’s, set a $1.1 billion leveraged loan, also to refinance debt.

Year to date, U.S. leveraged loan issuance totals $216 billion, down some 10% from this point last year. – Tim Cross

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.