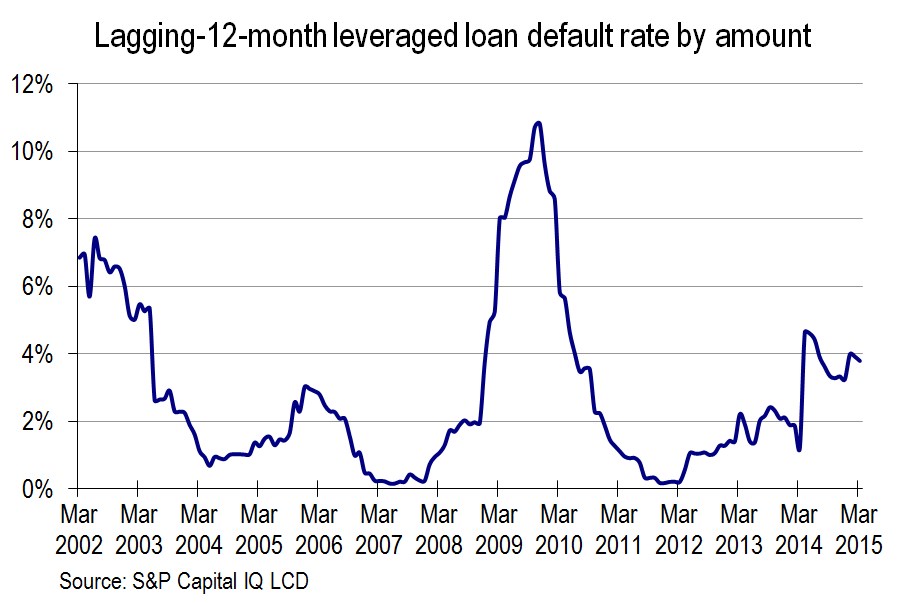

In March, for the second month running, there were no defaults among S&P/LSTA Index loans. As a result, the default rate by amount eased to 3.79%, from 3.92%.

Looking ahead, loan managers remain constructive on the near-term default outlook, according to LCD’s latest quarterly buyside survey conducted in early March. On average, participants expect the loan default rate to end 2015 at 1.63%, before ticking up to 1.81% by March 2016. By comparison, the historical average rate by amount is 3.23%. – Steve Miller

Follow Steve on Twitter for leveraged loan news and insight.

This story is taken from LCD’s full quarter-end default analysis, available to subscribers here.