As the markets head into the final months of the year, leveraged finance asset classes in both the U.S. and Europe are on course to record volumes at post-crisis highs. However, there is more to this picture that first meets the eye, as rapidly falling yields — often to record lows — have led borrowers to refinance in size, while new-money volumes have broadly been flat.

The dominance of refinancing activity in 2017 means the mood from arrangers and investors is not nearly as cheerful as the headline figures would suggest. “The low yield environment has spurred huge amounts of refinancing, while M&A volumes have been flat,” notes one head of syndicate. “And those need to pick-up before we see real growth.”

This view is echoed by another head of syndicate: “M&A and LBOs are the key to market growth. We will see fewer refinancings next year, as the current yield environment means a lot has already been done, but at levels that can’t be beaten in the near term. Companies have also locked in long-dated financing, so in the case of high-yield they will not get refinanced at first call.”

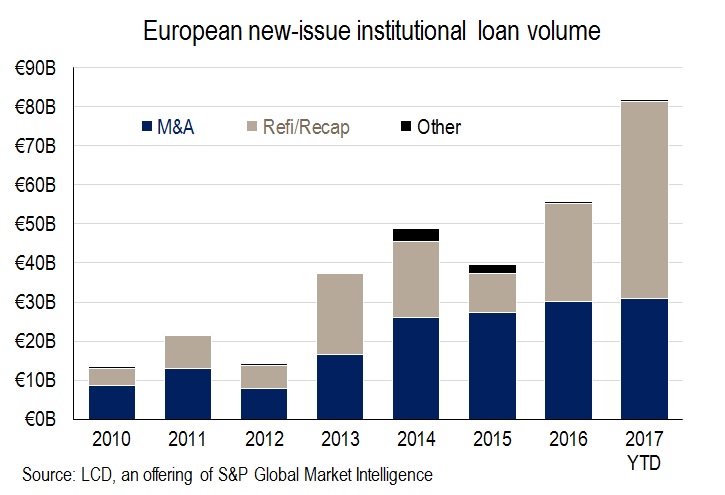

European institutional loan volume this year provides a good case in point. The total volume here is currently €81.7 billion, which is already roughly 47% higher than full-year 2016, and 106% higher than full-year 2015. And yet the acquisition-related portion, a proxy for new money, has been broadly flat in the last four years. That said, a late surge of issuance this month, which is very much possible, will see this year’s acquisition volume rise notably, and such supply is already running at a post-crisis high — the current tally of €31 billion this year is a smidgen ahead of the €30.1 billion seen in all of 2016, and €5 billion above the 2014 total.

In contrast, the volume from refinancing and recaps is €50.4 billion, which is double that seen last year, and only €4 billion less than the total for the last three years combined.

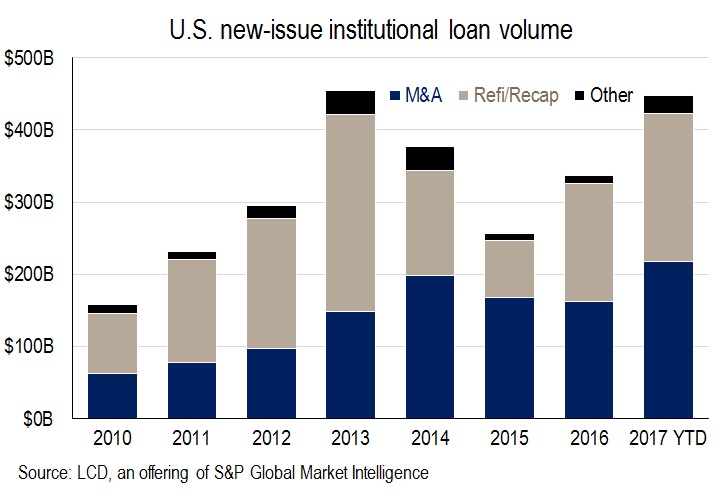

It is a better picture in the U.S., where new-money volume (acquisition-related issuance) has risen just over a third versus all of 2016, to a post-crisis high of $217.7 billion. That said, the refi/recap volume is also up 25% on last year, and while it is below the 2013 high, it is only the second year since the crisis to record a $200 billion-plus volume on this measure.— Luke Millar

Try LCD for Free! News, analysis, data

LCD comps is an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.