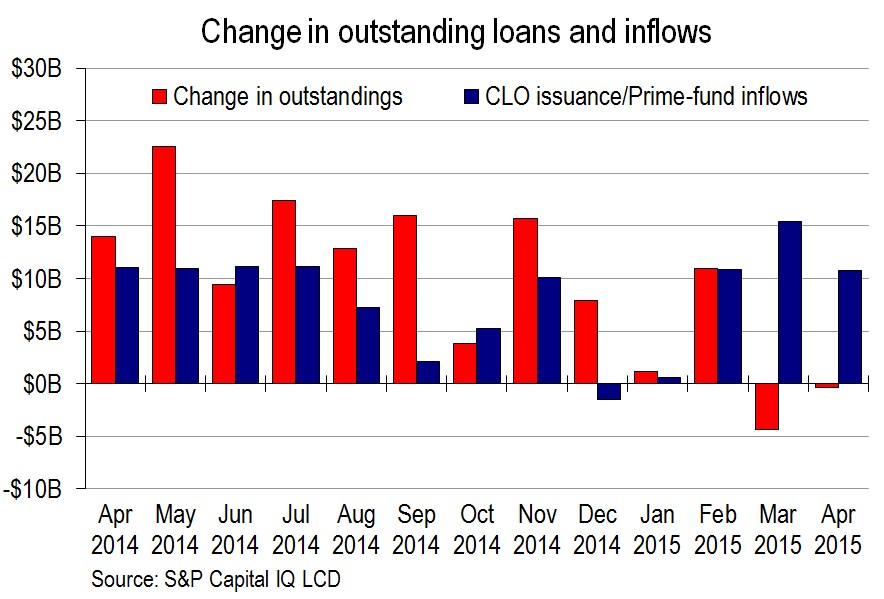

For leveraged loan managers trying to put money to work in the loan asset class, the technical environment went from bad to worse in April. It was simply a case of too much capital chasing too few opportunities, as visible inflows exceeded net new supply by $11.2 billion, following March’s record demand surplus of $19.8 billion.

The ongoing supply drought is largely responsible for today’s technical strength. In April, the universe of S&P/LSTA Index loans contracted by $418 million, to $837.8 billion, after dropping $4.4 billion in March. It was the first back-to-back months of shrinking supply in three years – Steve Miller

![]() Follow Steve on Twitter for leveraged loan news and insights.

Follow Steve on Twitter for leveraged loan news and insights.

This analysis is part of a longer story, available here to LCD News subscribers, that also details

- Leveraged loan outstandings

- M&A loan volume

- Monthly loan repayments

- CLO issuance

- Loan fund flows

- Leveraged loan secondary prices

- Leveraged loan yields

- Repricing volume

- Leveraged loan forward calendar