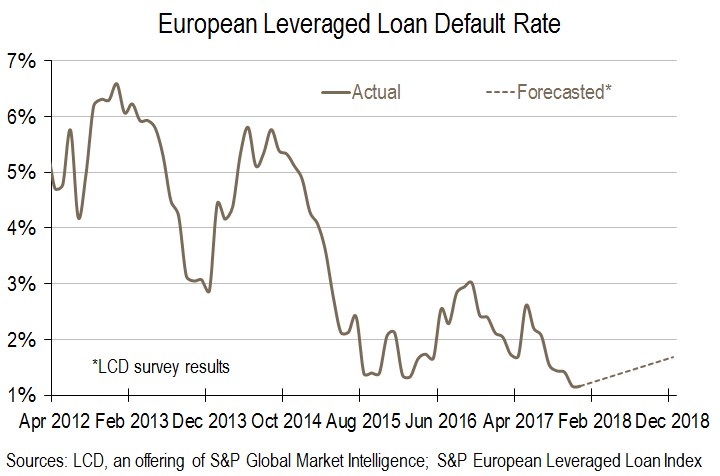

Investors in the leveraged finance market believe defaults will remain below 2% over the next 12 months, and will not rise back to the historical average until at least 2020, according to an LCD survey of European buyside investors.

But they were also in agreement that low default rates are not necessarily a comfort, as the real risks at the moment are in weaker documentation. “Default rates are becoming less relevant because documentation is so weak,” said one respondent. “Companies won’t default as quickly, so the default rate will be lower, but recoveries will also be lower.”

Default rates for loans in the S&P European Leveraged Loan Index (ELLI) by principal amount hit a record low of 1.16% in November, the lowest point since LCD began tracking this data in 2008. This was down from 1.41% in October, and from 2.43% a year ago in November 2016. – Taron Wade

Try LCD for Free! News, analysis, data

LCD comps is an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.