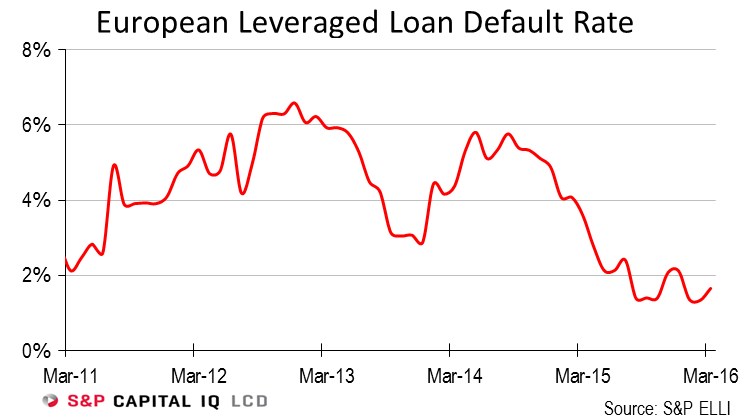

The lagging 12-month default rate for the S&P European Leveraged Loan Index (ELLI) was 1.7% in March, up from 1.3% in the 12-month period ended February, according to S&P Global Market Intelligence LCD. In the 12 months ended March 31, the ELLI tracked €1.5 billion of institutional loan defaults and restructurings, down from €2 billion at the end of last year.

The ELLI default rate is calculated by summing up the par amount outstanding for issuers represented within the Index that have defaulted in the last 12 months, and dividing that by the total amount outstanding in the Index at the beginning of the 12-month period (excluding issuers that have already defaulted prior to this date).

For the purposes of this analysis, LCD defines “default” as (a) an event of default, such as a D public rating, a D credit estimate, a missed interest or principal payment, or a bankruptcy filing; or (b) the beginning stages of formal restructuring, such as the start of negotiations between the company and lenders, or the hiring of financial advisors.- Staff Reports

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.

![]() Follow LCD News on Twitter

Follow LCD News on Twitter