What a difference a year makes.

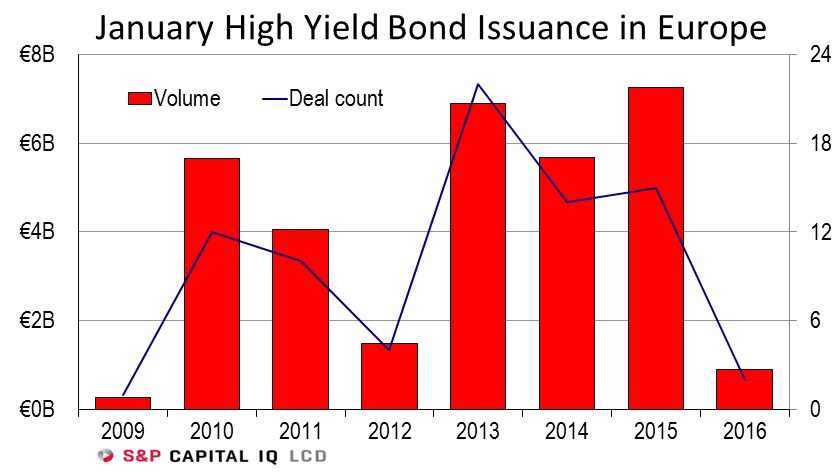

By this time in 2015 the European high yield bond market had priced a record January volume of €7.3 billion, from 15 trades (2013 holds the record January deal count of 22).

Then there’s 2016. This month has hosted two issuers – Telecom Italia and Atalian. What’s more, these two transactions total just €900 million, which is the lowest January primary deal count and volume recorded by LCD since 2009.

Of course, the high-yield primary has been impacted by the wider turmoil across financial markets, which has caused secondary cash prices to dip sharply, and in turn has led to fund outflows, stoking fears that ongoing outflows will exacerbate the falling cash prices. – Luke Millar

Follow Luke on Twitter for news and insight on the European leveraged finance market.

This story – which includes additional analysis – first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.