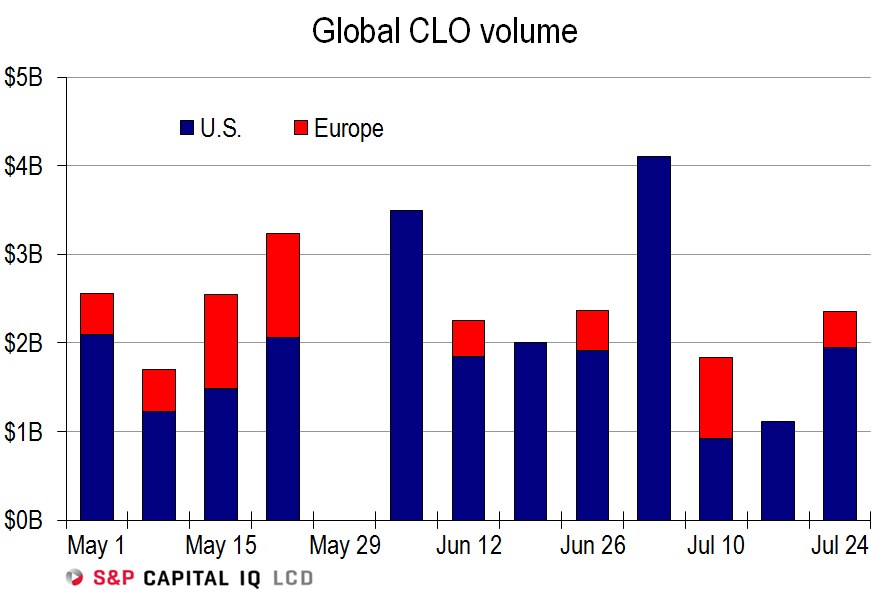

After a sluggish start to the month, it was an active week in the U.S., both in terms of new issues and on the regulatory front. Four U.S. new-issue transactions priced, while in Europe, AXA Investment Managers priced the third deal of the month, a €362.3 million transaction, via J.P. Morgan. Through Friday, July 24, global issuance rises to $73.67 billion.

The SEC provided much-awaited guidance that CLOs issued prior to Dec. 24, 2014 – the date the final risk-retention rule was published – will be able to refinance debt tranches under certain conditions after the rule takes effect in December 2016 without being subject to risk retention. The SEC’s position is reflected in a July 17 no-action letter in response to a request from Crescent Capital Group. It provides the market with clarity around the refinancing issue, which has been a topic of discussion since the final risk-retention rule was first published in October 2014. – Kerry Kantin/Isabell Witt

Year-to-date statistics, through July 24, are as follows:

- Global issuance totals $73.67 billion

- U.S. issuance totals $63.94 billion from 120 deals, versus $71.11 billion from 133 deals during the same period last year

- European issuance totals €8.75 billion from 22 deals, versus €6.92 billion from 16 deals during the same period last year

This analysis is taken from a longer LCD News story, available to subscribers here, that also details

- Recently priced CLOs

- CLO pipeline

- US CLO volume/outstandings

- European CLO volume/outstandings

- European priced CLOs