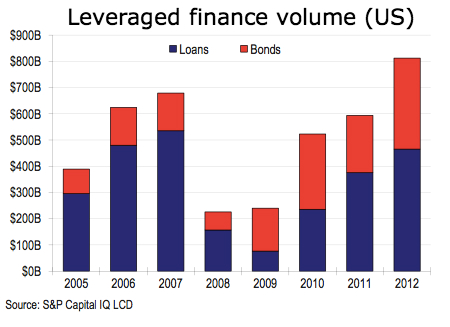

It will come as no surprise that leveraged finance volume – leveraged loan and high yield bond issuance – set a record in 2012, logging more than $800 billion in deals. The HY bond market did its part, to be sure, posting an unprecedented $346 billion during the year. Refinancings played a key role in both markets as issuers took advantage of sustained institutional investor cash to opportunistically redo deals.