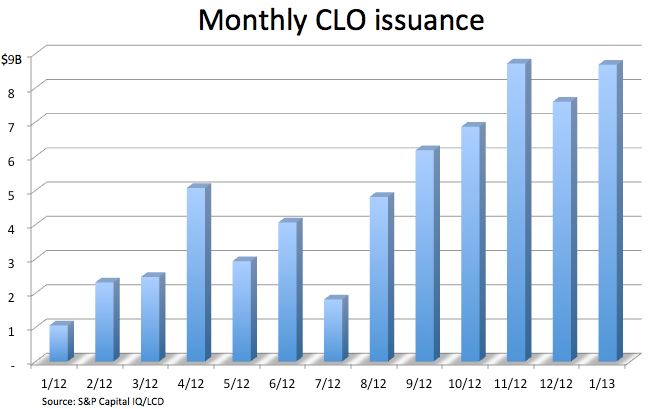

The CLO market took full advantage of insatiable institutional investor appetite in January, pricing $8.67 billion in collateralized loan obligation vehicles, nearly matching the amount seen in November (which was the busiest month for CLOs in 2012).

The eye-popping January issuance points to an even busier year for CLOs in 2013 than in 2012, when a healthy $54 billion in vehicles were priced. Indeed, accounts expect roughly $75 billion in CLOs this year, as LCD’s Kerry Kantin details here (subscription story). And the post-January pipeline looks strong, accounts add.

Of course, with the intense investor appetite, individual CLOs are getting larger. The average deal size is approaching the heft seen before the market meltdown of 2008.

You can read more about CLOs here, in LCD’s online Loan Market Primer.

Some of January’s notable CLOs: [table “2” not found /]