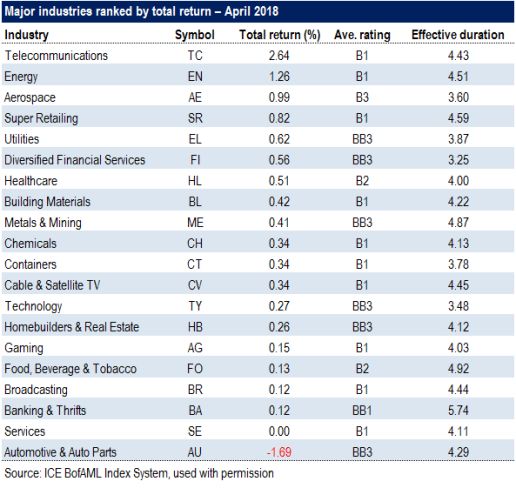

High yield expert Martin Fridson, on industry performance in the U.S. bond market (part of Marty’s weekly commentary for LCD):

Telecommunications led the 20 major high-yield industries in return in April, doubling the performance of the second-place finisher, Energy. Notwithstanding the outsized returns on Sprint issues (word emerged last month that Spring and T-Mobile were discussing a merger), the Telecom rally was quite broad-based. The non-Sprint portion of the ICE BofA Merrill Lynch High Yield Telecommunications Index returned 2.26%, still well ahead of runner-up Energy. As usual, Energy’s performance was closely tied to crude oil prices. As measured by West Texas Intermediate futures, the price surged from $64.87/bbl., to $68.57/bbl. in April.

Automotive & Auto Parts finished dead last, as it did in March. This time the industry’s return was strongly skewed by a single issuer, American Tire Distributors, which lost distribution rights for the Goodyear, Dunlop, and Kelly tire brands. The ATD 10.25% notes due 2022 accounted for just 2.3% of the ICE BofA Merrill Lynch High Yield Automotive & Auto Parts Industry’s market value, but its –47.12% return dragged down the –0.60% return for the rest of the group all the way to –1.69%. That being said, Automotive & Auto Parts was the only major industry to post a negative return in April.

Mary’s full weekly analysis is available to LCD News subscribers here.

Try LCD for Free! News, analysis, data

LCD comps is an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.