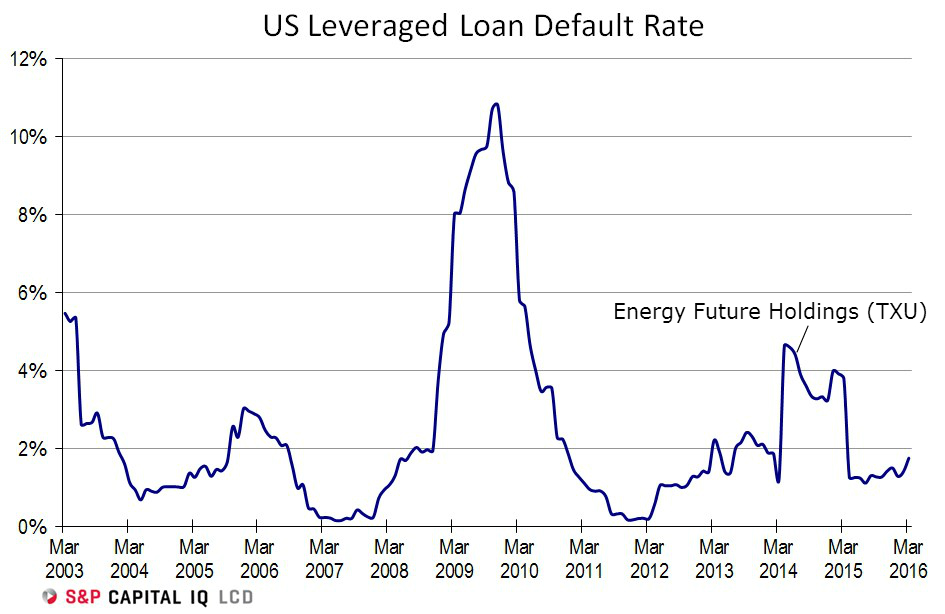

After another rough month for energy-related debt issuers, the U.S. leveraged loan default rate jumped to 1.75% in March from 1.41% in February, according to S&P Global Market Intelligence LCD.

There were four defaults during the month, three of which entailed energy companies: Templar Energy (oil & gas), Foresight Energy(coal), and Southcross Energy (natural gas). The other March default was courtesy Aspect Software, which supports the call conferencing/call centers market space.

The 1.75% March figure is the highest the U.S. leveraged loan default rate has been since Energy Future Holdings – the largest leveraged loan default ever – dropped off the lagging 12-month rolls one year ago.

Clearly, the rate is on the rise, though it remains low, compared to the 3.1% historical average, according to LCD.

How high will it go? According to LCD’s latest quarterly survey – conducted last month by Steve Miller – managers think the default rate will climb to roughly 2.5% one year from now, before pushing to 3.2% by the end of 2017. – Tim Cross

Follow LCD News on Twitter

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.