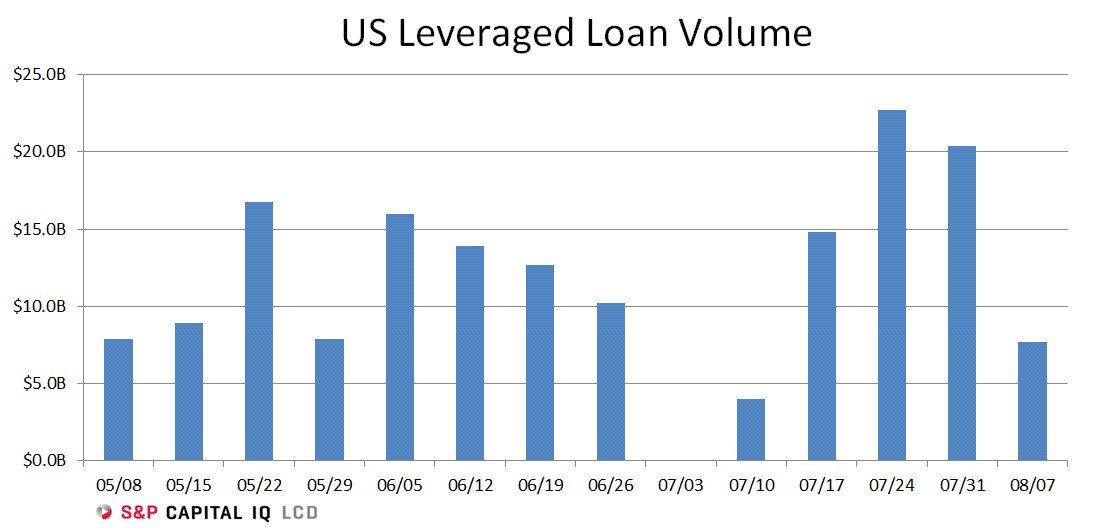

Leveraged loan issuance in the U.S. this week sank to $7.7 billion, from roughly $21 billion in each of the previous two weeks, according to S&P Capital IQ LCD. With the recent activity, loan volume so far in 2015 stands at $304 billion, down from $393 billion at this point in 2014.

It was a busy week in market movement – the drop in volume notwithstanding – with numerous deals flexed upward and downward during the syndications process.

The drop in volume proper coincides with a relatively large retreat from market by investors, which this week withdrew nearly $600 million from U.S. loan funds, the largest net outflow in six months, according to Lipper.