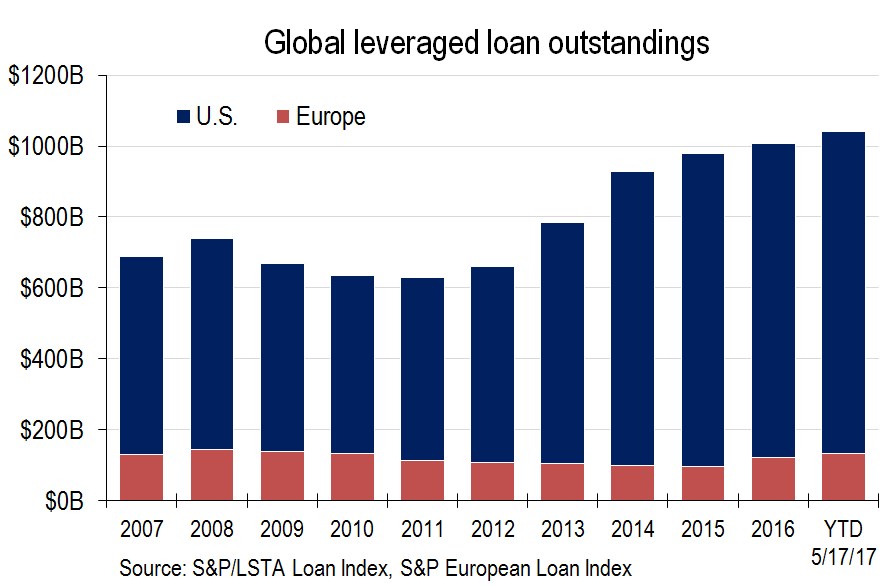

The combined U.S. and European leveraged loan markets hit a notable milestone recently, topping $1 trillion in size, according to LCD.

The boom in market growth comes as institutional investors continue to pour money into loan funds and ETFs – particularly in the U.S. – amid impressive issuance over the past few quarters.

In the U.S., leveraged loan outstandings hit $897 billion at the end of April, the most ever. They have been growing steadily since last October, amid inflows of cash into the leveraged loan asset class amid interest rate hike expectations.

In the European loan market, loan outstandings totaled €120 billion at the end of April. That market has been growing, as well.

U.S. leveraged loan market outstandings are tracked via the S&P/LSTA Loan Index while European outstandings are per S&P European Leveraged Loan Index.

Try LCD for Free! News, analysis, data

This story first appeared on www.lcdcomps.com, an offering of S&P Global Market Intelligence. LCD’s subscription site offers complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.