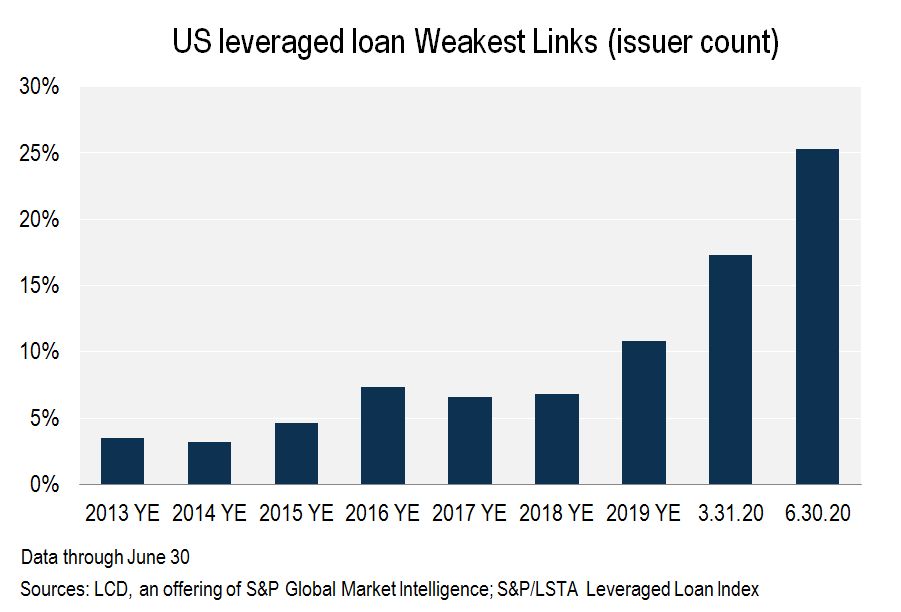

The COVID-19 pandemic has pushed the count and share of U.S. leveraged loan "Weakest Links" to record highs, again.

At the end of June — encompassing the first full-quarter reading since the onset of the coronavirus pandemic — the number of loan Weakest Links, as tracked by LCD, surged to 329 issuers, up from 227 in March and 145 in December 2019. As a result, the share of Weakest Links in the loan market rose to 25% at the end of June, from 17% at the end of March and from 11% at the end of 2019.

|

|

LCD's Weakest Links are loans with a Corporate Credit Rating of B- or lower and a negative outlook from S&P Global Ratings. The Loan Weakest Links composite can change historically as LCD's coverage expands the universe of loans it tracks for this analysis.

Register for our complimentary webinar on distressed debt in the energy sector:

Register NowRelated to the growing ranks of Weakest Links: With the coronavirus pandemic shuttering businesses and wreaking havoc on the U.S. economy, companies are increasingly drawing on their bank lines to lock in liquidity. Of the 329 Weakest Links tracked by LCD, 72 are included on LCD's revolver drawdown tracker — a list and industry breakdown of companies that have drawn their revolvers since early March, when effects of the coronavirus pandemic began to take root in the US economy.

In addition, the share of defaults and restructurings in Weakest Links analysis more than doubled in the last three months, to 44 as of June 30, versus 16 on March 31. This is the highest reading since the start date of this analysis, in 2013, up from the prior high of 27 issuers at the end of 2019. The majority of these 44 borrowers were on the list of loan Weakest Links before the onset of the COVID-19 pandemic. Some notable exceptions include Cirque Du Soleil Canada Inc., Men'sMen's Wearhouse, Hertz Global Holdings Inc. and CEC Entertainment Inc. These borrowers were not in the Weakest Links cohort at the end of 2019.

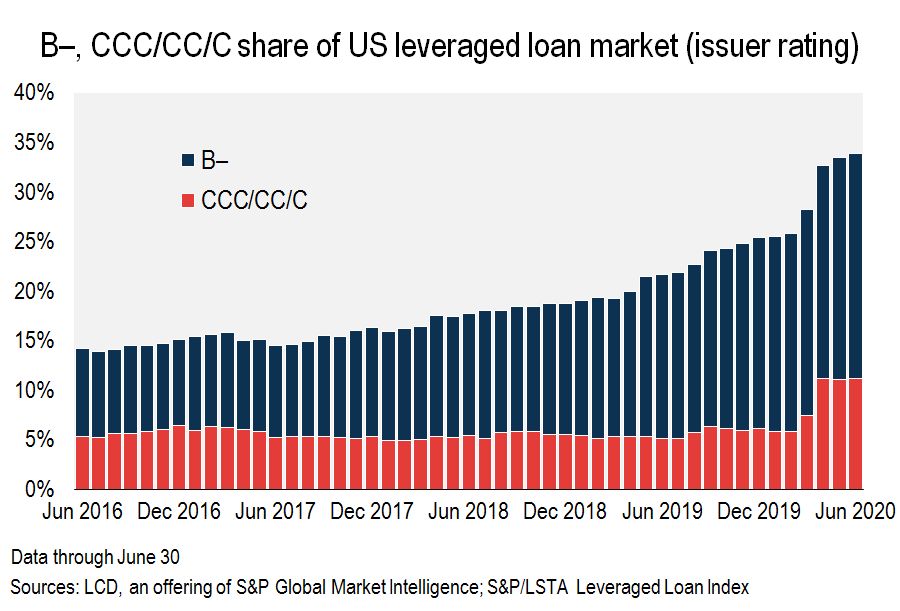

Both the downgrades and the worsening outlook contributed to the rise of loan Weakest Links in the second quarter of 2020. Out of the 329 issuers on the list, 137 are new to the cohort, including 63 that joined as a result of a one-notch downgrade to B- (with a negative outlook). Another 63 borrowers already had a B- rating but had a change in outlook, to negative, between April and June.

|

The pace of downgrades picked up during the second quarter, in the wake of the COVID-19 pandemic, leaving roughly a third of all issuers in the S&P/LSTA Leveraged Loan Index rated B- or lower (34% by par amount outstanding). This is a record high, up from 28% at the end of March and 22% a year ago. Issuers falling into the C to CCC+ range now account for 11% of the index, up from 7.5% three months earlier and 5% a year ago.

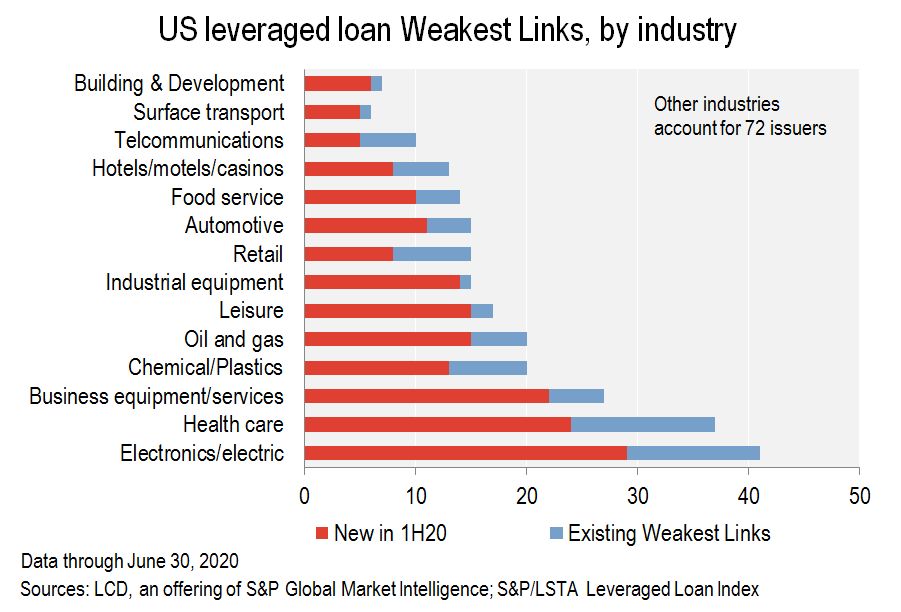

The effect of the COVID-19 related downgrades and worsening outlook spread across all sectors this year. The highest number of new additions and the overall number of Weakest Links came from electronics/electric (LCD's proxy for the technology sector), healthcare and business equipment/services. These sectors are also the three biggest industries in the loan market overall, collectively accounting for 34% of the $1.2 trillion institutional loan market, based on the S&P/LSTA Index. Their leading position among the Weakest Links is in line with their overall presence in the loan market.

|

In contrast, the entertainment and leisure and industrial equipment sectors saw a large spike in Weakest Links this year, relative to their overall presence in the cohort. Fifteen borrowers from entertainment and leisure joined the list in the first half of this year, bringing the total count to 17 (just two were in the cohort in 2019). Similarly, 14 out of the 15 industrial equipment borrowers were new this year.

|

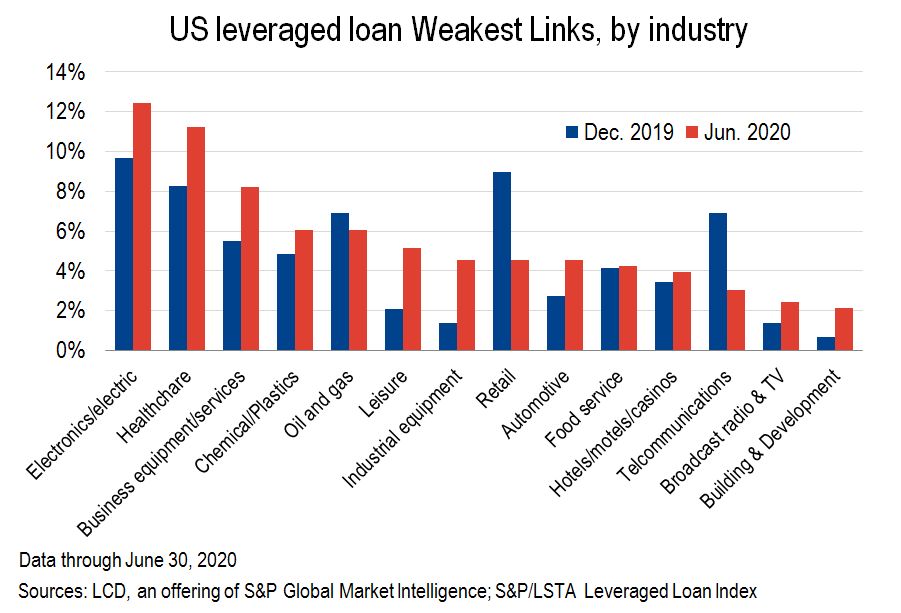

Looking at the data another way, the chart above shows each sector's share of the total Weakest Links as of June 30, versus the end of 2019, based on issuer count. While electronics/electric accounts for the top position both this year and in 2019, the second- and third-biggest sectors shifted away from retail and telecom, to healthcare and business equipment/services, respectively.

Retail, a sector which has dominated the corporate default landscape in recent years, saw a reduction to 5%, more in line with its overall share in the loan market, down from 9%. Most of the retail borrowers have been on investors' distress radar for a while now. Eleven out of the 15 companies from the sector on the current list joined before 2020. In addition, of the 44 defaults tracked in this analysis, six came from retail — the second-highest count, behind oil and gas, with seven issuers.

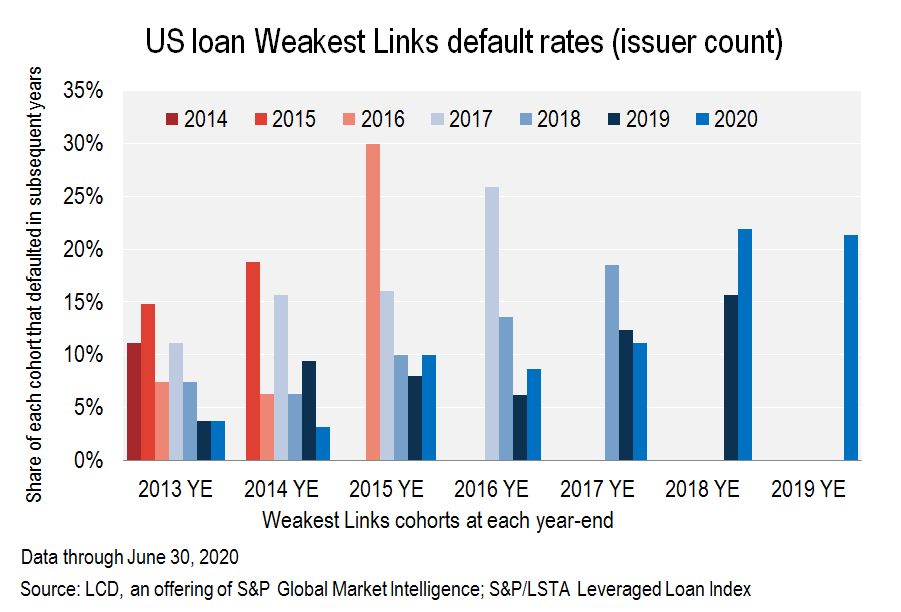

At the end of the second quarter, the U.S. leveraged loan default rate, by issuer count, rose to 3.7%, and by July 20, it had inched to 3.88%, a near-10 year high. As a result, a greater share of former Weakest Links have defaulted. Indeed, out of the 145 names on the list at the end of 2019, 10 issuers, or 7%, defaulted in first quarter 2020. This rate is higher when looking at the outcome for the first quarter Weakest Links; out of the 227 borrowers on the list on March 31, 24 defaulted between April and June, equating to an 11% rate.

|

Looking over the last six months, a total of 31 borrowers from the year-end 2019 Weakest Links cohort have defaulted, translating into a 21% rate. The sharp increase in Weakest Links so far in 2020 implies a heightened risk of default down the line.

Beyond default rates, another factor pointing to the health of the loan market is the ratio of downgrades to upgrades, especially those at the lower end of the credit quality spectrum. Through June, 35% of the loan market by par amount outstanding at the facility level had received a ratings downgrade, representing $411 billion of the $1.2 trillion of rated loans at the end of 2019. Also, covenant-relief activity spiked this year amid the economic fallout brought about by the coronavirus pandemic. Through the first half of this year, LCD tracked 114 covenant-relief transactions, just six shy of the total for the first six months of 2009, in the wake of the Great Financial Crisis.

This analysis was written by Marina Lukatsky, Senior Director of LCD Research.