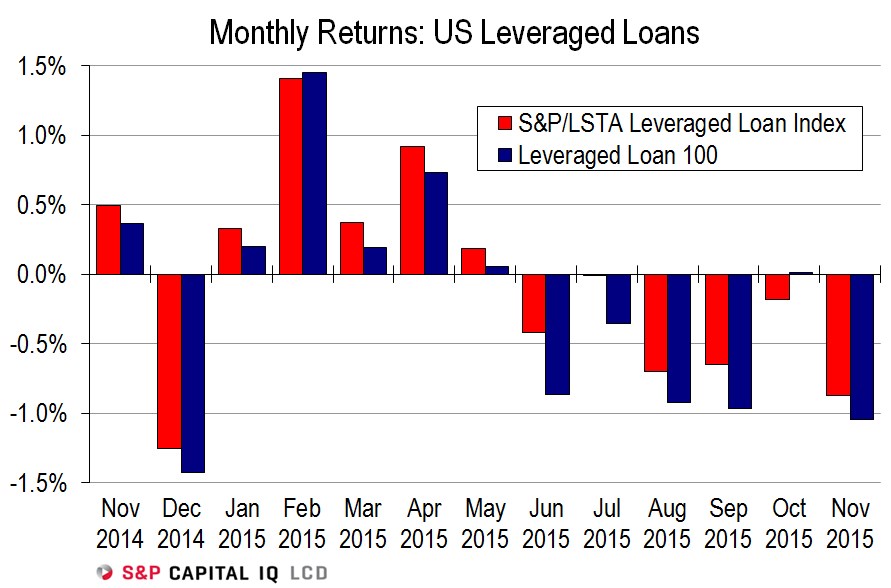

U.S. leveraged loans, as tracked by the S&P/LSTA Index, lost 0.88% in November amid weak technical conditions.

It was the loan market’s worst month since the Index fell 1.25% in December 2014, and it amplified the 0.18% loss in October. The largest loans that constitute the S&P/LSTA Loan 100 closely tracked the broader Index in November, falling 1.05%, after outperforming with a skinny 0.01% gain in October.

The S&P/LSTA Index has posted losses for six consecutive months, matching the period from July through December 2008 for the longest losing streak on record. Of course, the magnitude of the recent decline, at 2.80%, pales beside that of the second half of 2008, when the Index collapsed a record 28.32% during the worst capital markets carnage since the Great Depression.

To put the performance of the past six month in context, it is the fourth-worst half-year performance for the Index on record. – Steve Miller

Follow Steve on Twitter for leveraged loan market news and insight.