Major U.S. cloud services providers all reported recent gains in revenue and expenses driven in part by demand for new hybrid cloud computing products.

While cloud computing refers to storing data on centralized computers, new hybrid solutions also offer processing closer to or even on company premises. Companies are interested in hybrid cloud products both for efficiency and security reasons amid an explosion in data-processing demands, technology executives said in recent earnings calls.

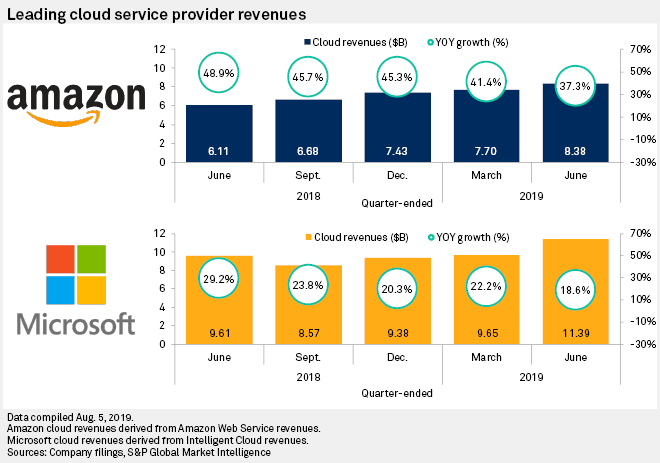

The top two cloud providers, Amazon.com Inc. and Microsoft Corp., reported year-over-year growth of 37.3% and 18.6% in their respective cloud-related segments. While Microsoft's intelligent cloud segment reported the larger top-line figure, with $11.39 billion in revenue versus $8.38 billion from Amazon's web services segment, analysts generally consider Amazon the cloud leader. Microsoft includes results from its server products and enterprise services as well as its primary cloud product Azure in the intelligence cloud total.

Alphabet Inc.'s Google does not break out a cloud-related reporting segment from within its larger business, but company executives said Google Cloud is at an $8 billion annual run rate as of the June quarter, implying growth above the $1 billion in quarterly cloud revenue it reported in June. That puts Google at a distant third in U.S. cloud computing, behind Amazon and Microsoft, though Google executives said cloud is a revenue driver for the company.

"Cloud was the largest driver within other revenues and the third-largest driver of revenue growth for Alphabet overall," Alphabet CFO Ruth Porat said on its June quarter earnings webcast.

Microsoft executives also cited the cloud — and specifically Azure — as one of the leading growth drivers in its corporate integrated business, which includes a range of software like Windows, hardware like Surface products, gaming under its PlayStation brands and social media under LinkedIn. Azure revenue grew 64% year over year during the quarter. Some of that growth is due to technology that extends Azure services to the edge of the network for a hybrid cloud offering, Microsoft CEO Satya Nadella said during the company's June-quarter webcast.

Google CEO Sundar Pichai cited Alphabet's April partnership with Intel to create the Anthos hardware platform as a key development in making the company more competitive for hybrid cloud customers. "Customers need flexibility to move to cloud in their own way," Pichai said.

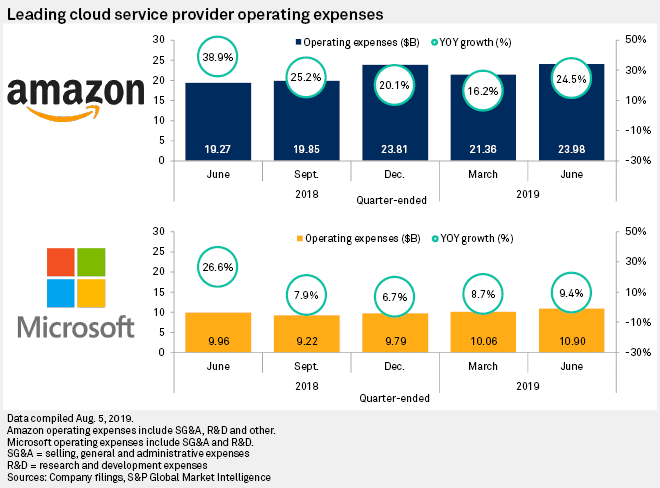

Cloud-related innovations are also driving expense growth. Microsoft's Nadella said that cloud investments were a leading driver of Microsoft's corporate expense growth, but clarified that the investments are largely related to new capacity, not necessarily expanding Microsoft's data-center footprint. Amazon executives did not mention hybrid cloud solutions on the company's earnings call, saying much of Amazon's cloud-led expense growth was driven by new marketing and sales investments.

Microsoft's consolidated expenses climbed 9.4% year over year to $10.90 billion, with intelligent cloud reporting a 23% increase in expenses for the quarter, CFO Amy Hood said.

For the June quarter, Amazon saw operating expenses grow 24.5% to $23.98 billion, which executives attributed largely to workforce growth — much of it at AWS. AWS-specific expenses totaled $6.26 billion in the June quarter, up from $4.46 billion in the year-ago period.

Google also cited cloud as driving higher-than-expected headcount growth. The Alphabet unit said its capital expenditures grew to $6.90 billion from $5.30 billion in the 2018 quarter, up about 30% year over year.