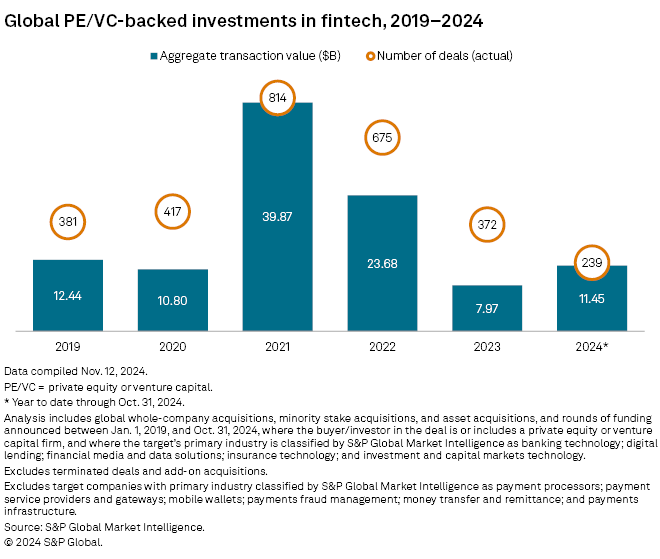

The number of global private equity-backed investments in financial technology is set to fall for the third consecutive year, continuing a decline from the private capital investment spree in fintech during 2021.

The total count of private equity and venture capital-backed investments and funding rounds in fintech stood at 239 in the first 10 months of 2024, representing about 64% of deals recorded in all of 2023, according to S&P Global Market Intelligence data.

For this analysis, fintech is defined as the application of technology in the delivery of banking and financial services, excluding payments.

The drop in the number of deals can be seen as a correction from the high activity days in 2021 and 2022, when venture capital firms were willing to write checks to nearly any fintech company, said Sampath Sharma Nariyanuri, senior fintech analyst for 451 Research, a technology research group within Market Intelligence.

"VCs were under enormous pressure to back startups, even those startups that hadn't figured out ways to develop a sustainable business model," Nariyanuri said. "As the capital markets corrected, VC investors exercised greater due diligence...and they have realized that a lot of funding requests for startups were not worth sponsoring."

– Download a spreadsheet with data in this story.

– Read about global private equity investments in payments.

– Explore more private equity coverage.

Later-stage investments

The sector has shown signs of recovery in 2024, indicated by the year-over-year increase in deal value, Nariyanuri said. Private equity and venture capital deal value in the sector totaled $11.45 billion in the year through Oct. 31, surpassing $7.97 billion secured for all of 2023, according to Market Intelligence data.

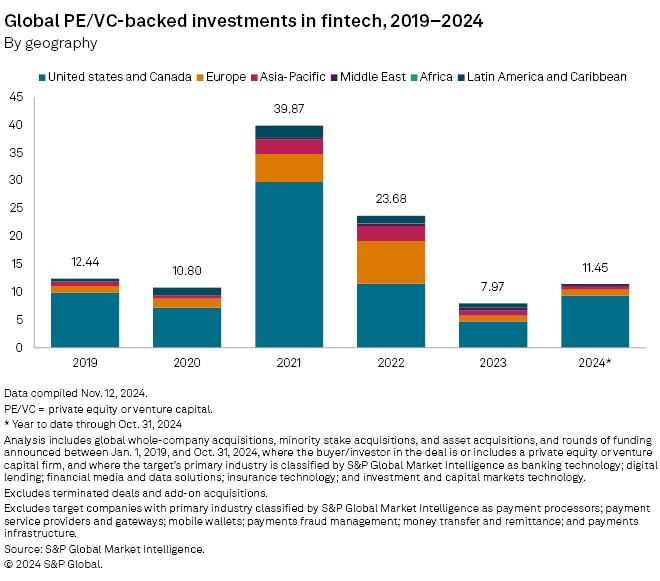

The US and Canada secured the largest amount at $9.36 billion, followed by Europe and Asia-Pacific with $1.18 billion and $600.1 million, respectively.

"Deal value has certainly shown some improvement, largely because a lot of private equity companies and venture capital firms are writing bigger checks or investing bigger amounts into late-stage rounds," Nariyanuri said.

"You mostly have established firms raising capital. Because these companies have already gained scale and have demonstrated a track record of some sort of profitability, they have won the favor of investors."

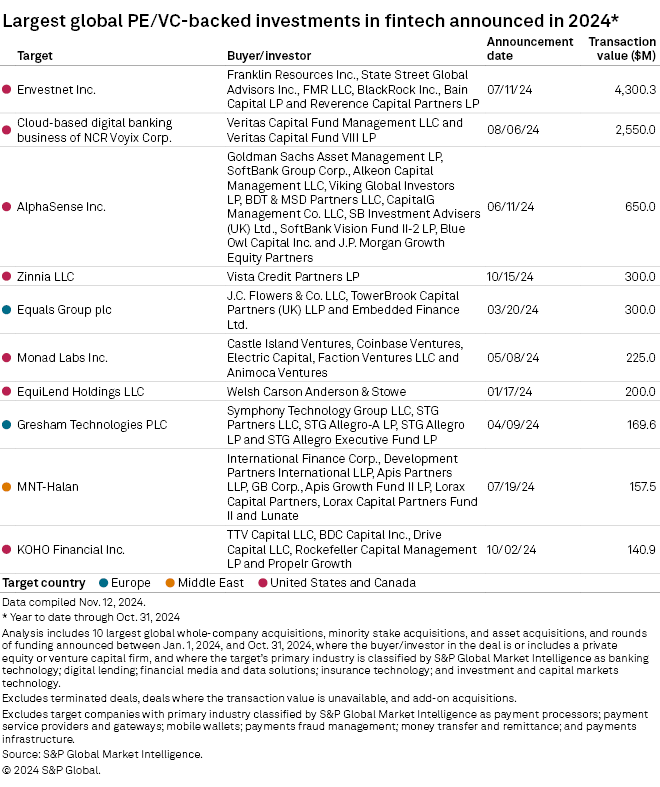

In the biggest deal of the year through Oct. 31, an investor group including Bain Capital LP and Reverence Capital Partners LP agreed to buy wealth management software company Envestnet Inc. for about $4.30 billion.

The largest funding round so far in 2024 was the $650 million round for financial and company search engine solutions provider AlphaSense Inc. Firms including CapitalG Management Co. LLC, JP Morgan Growth Equity Partners and SB Investment Advisers (UK) Ltd. participated in the round.

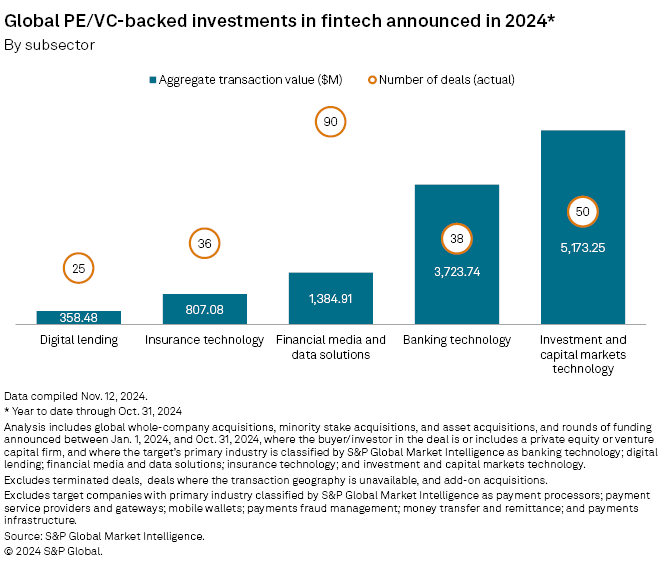

In terms of fintech subsectors, investment and capital markets technology secured the biggest amount of private equity funding at $5.17 billion. Banking technology came next with $3.72 billion. Financial media and data solutions companies recorded 90 transactions, the highest number of deals among fintech subsectors.

Outlook

"