Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jul, 2022

By David Feliba and Rehan Ahmad

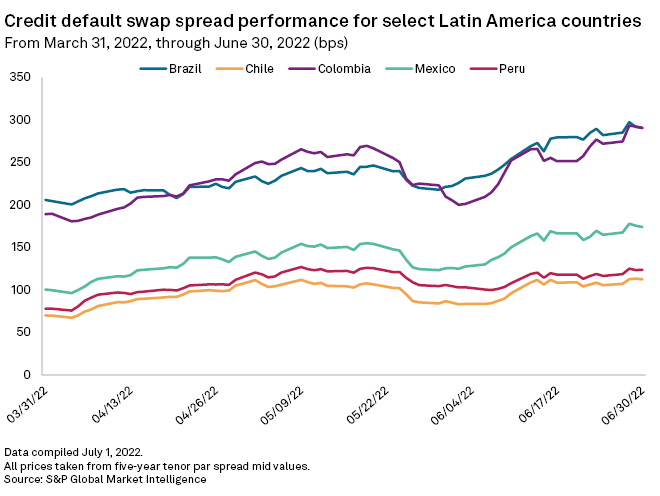

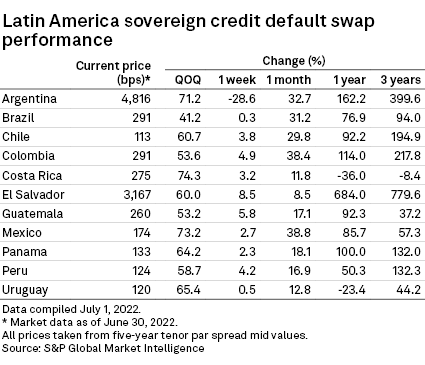

Latin American credit risk rose in the second quarter of 2022 as higher interest rates and looming political risks add up to a challenging outlook for regional economies.

The cost of insurance against default rose in all of the major economies in Latin America during the three-month period, as measured by credit default swaps, or CDS.

Brazil, the region's largest economy, saw a 41.2% increase in its 5-year CDS prices during the period to end the quarter at 291 basis points. The country is facing a highly polarized presidential election later this year between incumbent Jair Bolsonaro and leftwing former president and Workers Party strongman Luiz Inacio Lula da Silva.

Lula, as the former president is widely known, is leading the polls ahead of the October elections. Analysts expect political uncertainty to impact the economy this year as corporate investment will likely decelerate until after the elections. The country is already struggling to deliver economic growth this year, which S&P Global Market Intelligence estimates at 1.3% of GDP for 2022.

In Colombia, where presidential elections were decided in June, CDS rose 53.6% from the previous quarter. Gustavo Petro, a left-wing politician and former guerrilla member, clinched the presidency in what could mark a turning point for a country that is used to more market-friendly governments.

Political uncertainty has also seeped into Chile's markets, traditionally perceived by investors as the region's safest. CDS rose by 60.7% in the quarter as the government led by Gabriel Boric prepares a tax reform that could impact key sectors in the economy. Boric also received the draft for a new constitution July 4, which Chileans will either ratify or reject later this year.

Mexico, the second-largest economy in Latin America, recorded one of the largest quarterly increases with a 73.2% spike in CDS. The cost of insuring against a Mexican sovereign default went up to 174 basis points by the end of the second quarter.

Debt prices have also been affected by rising rates in the U.S. The U.S. Federal Reserve rose its benchmark federal-funds rate by 75 basis points in June, the largest interest rate hike in nearly two decades. U.S. 10-Year Treasury bond yields, typically known as the risk-free rates, rose by 66 basis points in the quarter, up to 2.98% by June 30.

In El Salvador, the five-year credit default swap exploded to 3,167 basis points. The Central American country saw its CDS prices increase by as much as 60% in the quarter as the country's bet on bitcoin appears to have backfired as global risk aversion sends cryptocurrencies tanking across the board.

Argentina's debt insurance meanwhile skyrocketed by 71.2% to 4,816 basis points as the country's financial crisis deepens and the peso plummets.

Argentina cleared its first review with the International Monetary Fund, but analysts remain skeptical about the country's ability to meet full-year targets stipulated in the agreement for 2022, which include an adjustment of the primary deficit and lower monetary financing.