S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

A decidedly downbeat midyear update released this week by KKR & Co. Inc. is just the latest confirmation that rapid changes in the global economy since the start of the year have dimmed the outlook for private equity.

"Walk, don't run" is how the large publicly traded alternative asset manager summarized its current, more cautious approach to capital deployment. According to the report's author, Henry McVey, head of KKR's global macro, balance sheet and risk team, many investors are still underestimating the toll inflation will take on corporate profits, especially rising prices for food and energy.

McVey's prediction for the U.S. economy is an "abrupt slowdown, verging on mild recession, playing out by 2023," with corporate earnings for S&P 500-listed companies sliding 5% in 2023.

Inflation and uncertainty about the future are creating discomfort for investors, he added, pointing to the prospect of a prolonged conflict in Ukraine leading to greater "economic polarization" and competition between the world's economic powers.

"Without question, current market conditions are about as choppy as I have seen during my career," McVey wrote.

Read more on the private equity firm's midyear report.

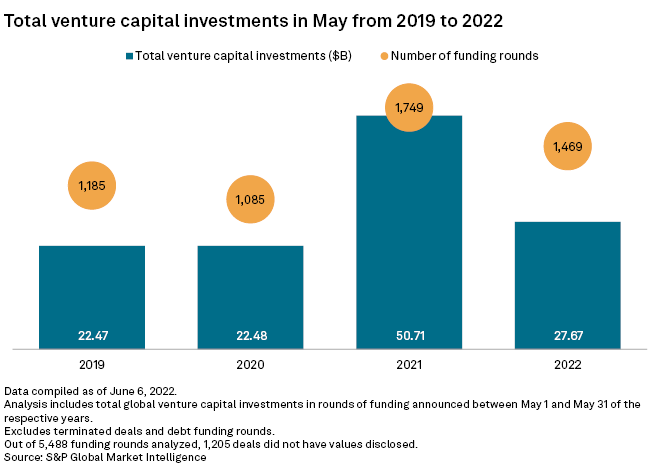

CHART OF THE WEEK: Global venture capital investments continue slide

⮞ Global venture capital investments totaled $27.67 billion in May, a decline of 45.4% from the total for the same month a year ago. That is an even bigger drop than the 37% year-over-year decline in April.

⮞ The total number of rounds dropped 16% in May from the same month a year ago, almost identical to the 15.9% year-over-year decline seen in April.

⮞ The largest venture capital transaction of the month was a $1.1 billion mature funding round for CNNP Rich Energy Corp. Ltd.

FUNDRAISING AND DEALS

* Australia's Federal Court approved Blackstone Inc.'s planned acquisition of Crown Resorts Ltd., Dow Jones Newswires reported. Blackstone will pay $9 per share to the shareholders of the Australian casino operator in a cash deal valued at about $6.3 billion.

* Blackstone unit Blackstone Growth provided $130 million in series C financing to PayCargo LLC, a payments and data insights platform provider for logistics companies.

* Bain Capital LP and J.C. Flowers & Co. LLC are looking to jointly acquire a 40% stake in Together Financial Services Ltd., Sky News reported. Centerbridge Partners LP and Bayview Asset Management LLC are also preparing their bid for a minority stake in the mortgage lender, according to the report.

* Australia and New Zealand Banking Group Ltd. is reportedly in talks to buy accounting software specialist MYOB from KKR & Co. Inc., The Australian Financial Review's Street Talk blog said.

ELSEWHERE IN THE INDUSTRY

* Hg agreed to exit MediFox Dan, a German provider of hospital software solutions, in an approximately $1 billion deal with ResMed Inc.

* AnaCap Financial Partners Ltd. will acquire digital invoice distribution platform and bill payment solutions company EDIGard AS.

* Northlane Capital Partners LLC purchased a majority interest in Infobase Holdings LLC, which provides cloud-based educational solutions.

* Glade Brook Capital Partners LLC pulled in $430 million for Glade Brook Strategic Growth III LP, a fund that invests in software, e-commerce, financial technology, Web3, digital health and digital media businesses.

FOCUS ON: FOOD AND AGRICULTURE

* Funds managed by Apollo Global Management Inc.'s affiliates will acquire Cardenas Markets Inc., a Hispanic grocery retailer, from KKR-affiliated funds. The deal is expected to close in the third quarter.

* TPG Capital LP's The Rise Fund led a $300 million equity financing for Little Leaf Farms LLC, which is a packaged lettuce brand.

* Highpost Capital LLC led an $85 million funding round for celebrity-backed cereal brand Magic Spoon Inc., Dow Jones reported.