After a 10.5-month hiatus, Kentucky bank M&A sprung back to life last month with two deals announced in the span of a week.

This article is part of S&P Global Market Intelligence's series of state profiles, which take an in-depth look at M&A and key banking metrics for banks and thrifts with less than $10 billion in assets.

Peaks and valleys in the Bluegrass State

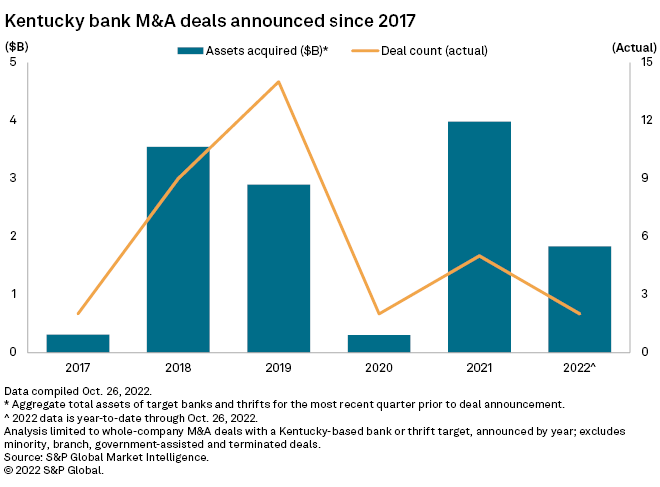

Kentucky bank M&A was on a hot streak prior to this cold spell of nearly a year. Nine deals were announced in the state in 2018 and 14 in 2019, not including terminated deals.

Last year, while only five deals were announced, the size of the targets surged and reached a two-decade high. The targeted companies reported a combined $3.98 billion in assets prior to their deal announcements, the highest yearly level in the state since 2001, according to S&P Global Market Intelligence data.

Cross-border activity

Both of this year's acquisitions include buyers from neighboring states.

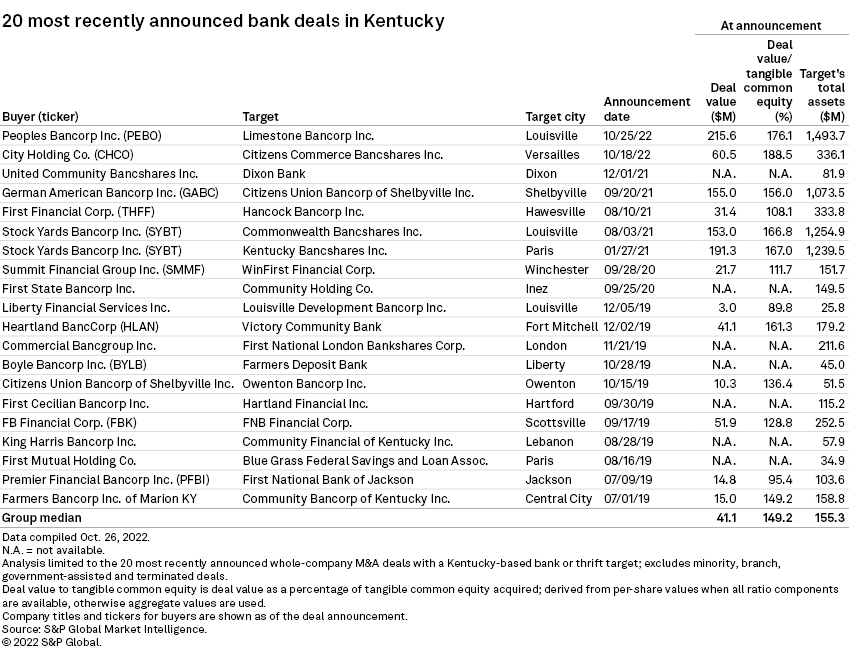

Most recently, on Oct. 25, Marietta, Ohio-based Peoples Bancorp Inc. announced that it would acquire Louisville, Ky.-based Limestone Bancorp Inc. for $215.6 million, the state's largest deal since April 2018 when Wheeling, W.Va.-based WesBanco Inc. announced it planned to buy Frankfort-based Farmers Capital Bank Corp.

The deal was Peoples' 10th whole-bank acquisition announcement since 2012. The company's last Kentucky acquisition came in October 2018 when it announced its deal with Prestonsburg-based First Prestonsburg Bancshares Inc.

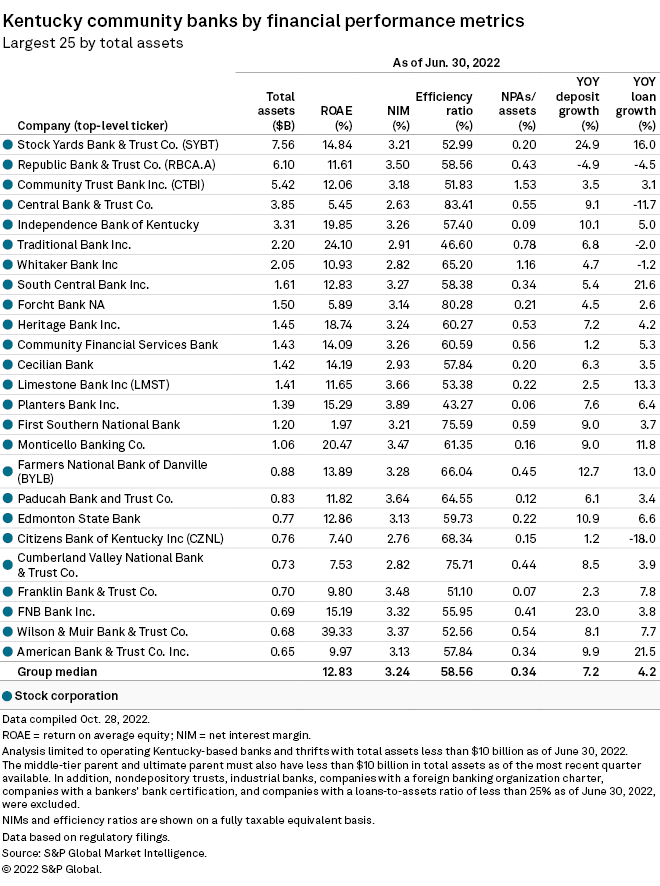

Limestone Bancorp's subsidiary, Limestone Bank Inc., was the 13th-largest Kentucky community bank by assets as of June 30.

A week prior to the Peoples' deal announcement, on Oct. 18, Charleston, W.Va.-based City Holding Co. announced its own $60.5 million deal for Versailles, Ky.-based Citizens Commerce Bancshares Inc., its third Kentucky whole-bank deal since 2018.

Kentucky's largest community banks bulking up

Louisville-based Stock Yards Bancorp Inc., the holding company of Kentucky's largest community bank under $10 billion in assets, has been an active acquirer in recent years, closing on its $153.0 million purchase of Louisville-based Commonwealth Bancshares Inc. in March and its $191.3 million deal for Paris, Ky.-based Kentucky Bancshares Inc. in May 2021.

* Download a state banking profile template in Excel.

* Click here to set email alerts for future Data Dispatch articles.

Louisville-based Republic Bancorp Inc., parent of the state's second-largest community bank, announced its own cross-border acquisition last month, paying $51.0 million to buy Cincinnati-based CBank in a deal expected to close in the first quarter of 2023.