Retail industry watchers expressed optimism about an increase in retail sales in June as two retailers filed for bankruptcy during the late June through early July period, according to an analysis by S&P Global Market Intelligence.

Retail sales

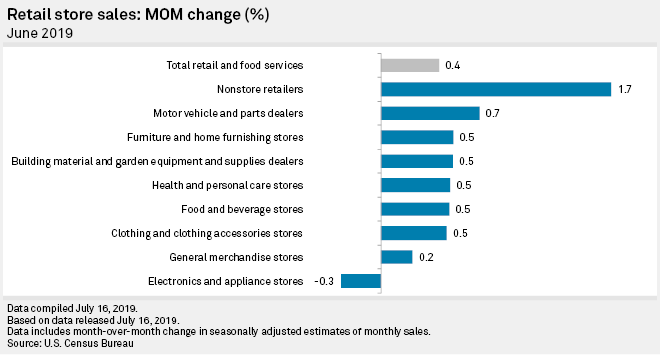

U.S. retail and food services sales increased 0.4% on a seasonally adjusted basis to $519.89 billion in June from the previous month, according to a report released July 16 by the U.S. Census Bureau.

"These are impressive results showing that the consumers remain engaged and that consumer spending gave a boost to the economy in the second quarter," NRF Chief Economist Jack Kleinhenz said in a statement. He added that the numbers are "consistent with elevated consumer sentiment, healthy household balance sheets, low inflation and, wage and job gains."

Kleinhenz said trade uncertainties continue to weigh on the long-term outlook even as the possibility of tariff increases has subsided for the moment.

In an interview with Market Intelligence, James Bohnaker, associate director at IHS Markit, said he expects stronger numbers.

"We have seen some better recovery in retail sales, which we have expected for a few months now, so it is consistent with what we are seeing in terms of the job market and in terms of the income growth. So, as long as that remains a pretty solid trend, then retail sales should follow suit."

Nonstore retailers, a category that includes e-commerce companies, registered a month-over-month sales increase of 1.7%. Sales in the subsector were $64.72 billion for the month.

Sales at motor vehicle and parts dealers increased by 0.7% to $104.5 billion during June.

Food and beverage stores registered a 0.5% increase in sales to $64.66 billion. Sales at clothing and clothing accessories stores grew 0.5% month over month in June to $22.49 billion.

Sales at electronics and appliance stores decreased by 0.3% to $8.12 billion.

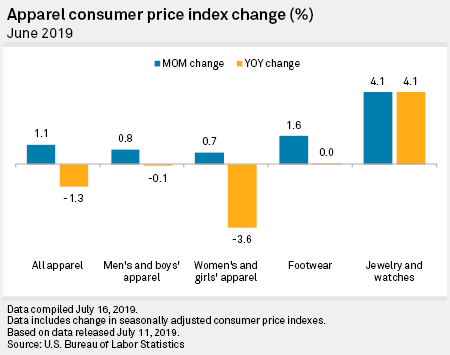

Consumer prices increased 0.1% in June from May, according to a monthly report released July 11 by the U.S. Bureau of Labor Statistics. Prices jumped 1.6% year over year.

Prices for apparel increased by 1.1% month over month in June, with men's and boys' apparel rising by 0.8%. Prices for women's and girls' apparel also rose 0.7%.

Footwear prices increased by 1.6%, while prices of jewelry and watches jumped 4.1% during the period.

Bankruptcy

Two Market Intelligence-covered U.S. retail companies filed for bankruptcy in late June and early July. The filings bring the bankruptcy count for 2019 to 20.

Tara Jewels Holdings Inc., which imports and distributes diamonds and jewelry, filed a voluntary petition for reorganization under Chapter 11 on June 21.

Fashion accessories retailer Charming Charlie Holdings Inc. on July 11 filed for Chapter 11 bankruptcy protection for the second time. The company listed its assets in the range of less than $50,000 and liabilities of $50 million to $100 million. The company first emerged from bankruptcy on April 24, 2018.

Market Intelligence's bankruptcy count includes companies with a primary industry classification of retailing, household and personal products, or consumer durables and apparel, and secondary classification of retailing. Public companies included in the list of companies with public debt must have at least $2 million in either assets or liabilities at the time of the bankruptcy filing, while private companies must include at least $10 million.

WBP Liquidation Co. Inc., which had an involuntary petition for liquidation under Chapter 7 filed against it April 17 and was included in Market Intelligence's past tallies of bankruptcies, has been removed from Market Intelligence's current list. Market Intelligence discovered that WBP's total assets and liabilities did not reach the threshold requirement for inclusion.

Employment

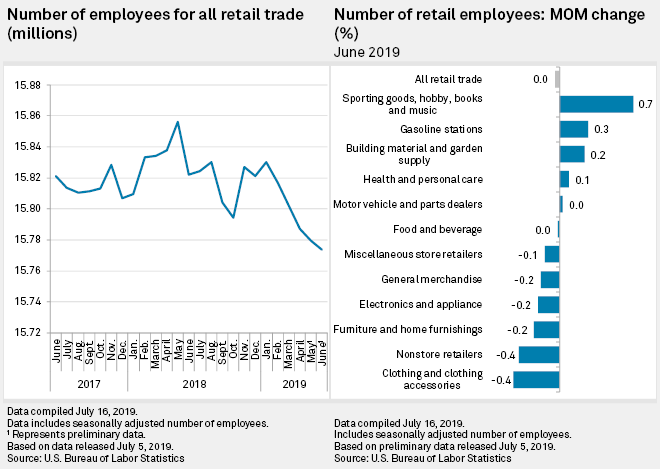

The retail sector lost 5,800 jobs in June, down to 15.8 million jobs. That is a decrease of 0.04% from May, according to a July 5 monthly report from the U.S. Bureau of Labor Statistics.

Clothing and clothing accessories stores lost 5,500 jobs, or 0.41%, to a total of 1.3 million jobs in June. Nonstore retailers lost 2,100 jobs, or 0.36%, to a total of 580,400 jobs during the month.

Employment at sporting goods, hobby, books and music stores rose by 3,700 jobs, a 0.66% increase to 562,800 jobs.

Gasoline stations added 2,400 jobs, or 0.25%, in June to 949,200 jobs.

Vulnerability

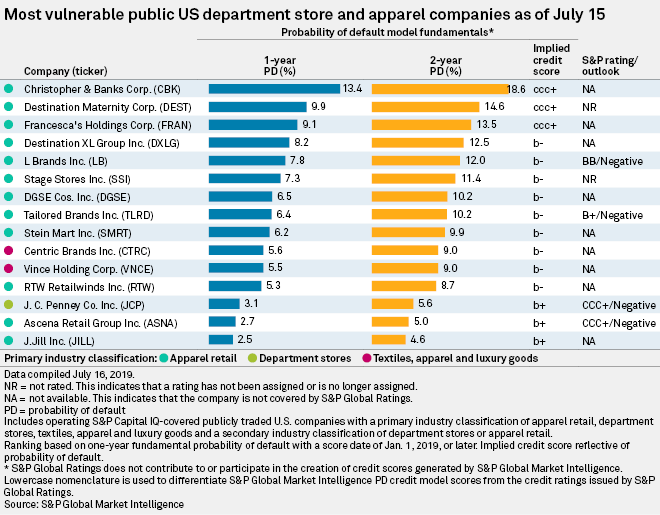

A July analysis of the one-year probability of default scores identified 15 U.S. department stores and apparel companies with scores ranging from 13.4% to 2.5% and corresponding implied credit scores of "ccc+" to "b+."

Several retailers shifted positions as calculated one-year probability of default changed for most of the companies on the list.

Specialty retailer Christopher & Banks Corp. continued to top the list, but the company's one-year probability of default increased to 13.4% from 13.3% in June.

Francesca's Holdings Corp., which holds the No. 3 spot now, saw its probability of default increase to 9.1%, up from 5.4% the month prior. This bumped Destination XL Group Inc. down to the No. 4 spot, maintaining its probability of default of 8.2%.

Stage Stores Inc.'s one-year probability of default score increased to 7.3% from 7.2%, but the company fell to the No. 6 spot from No. 5. Tailored Brands Inc., which previously held the No. 12 spot, rose to No. 8 with a probability of default of 6.4%.

S&P Global's Fundamental Probability of Default Model provides a fundamentals-based view of credit risk for corporations by assessing both business risk — including country risk, industry risk, macroeconomic risk, company competitiveness and company management — as well as financial risk, such as liquidity, profitability, efficiency, debt service capacity and leverage. For a more thorough review of the model, see the PD Model Fundamentals - Public Corporates whitepaper. |