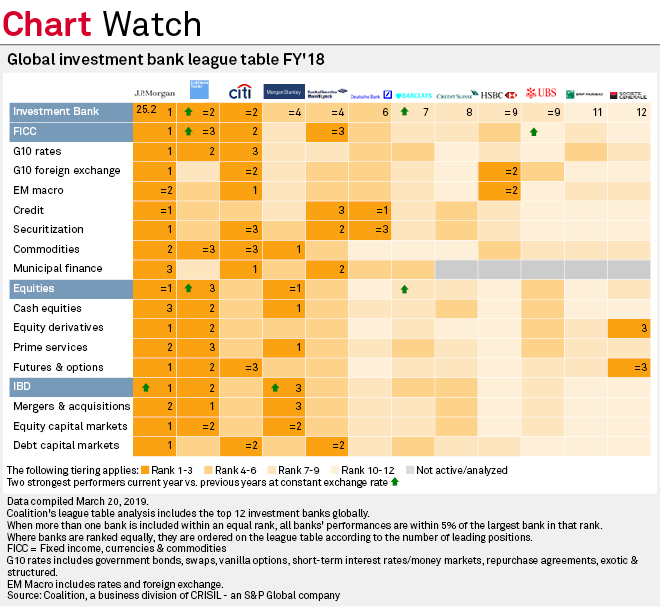

The return of capital market volatility did not ruin the multiyear winning streak of JPMorgan Chase & Co. as the U.S. banking group topped the global investment banking league table of research firm Coalition yet again.

Coalition ranks the leading 12 global investment banks by revenues twice a year. JPMorgan has led the ranking on a half- and full-year basis since 2015, and the five biggest U.S. investment banks — also including Citigroup Inc., Goldman Sachs Group Inc., Morgan Stanley and Bank of America Corp. — have occupied the top five spots.

|

Several strong bouts of volatility swayed global investment bank revenues in 2018. While some, especially among the U.S. groups, profited from the ups and downs over the first three-quarters of the year, the last three months of 2018 were tough for all banks. Global stock selloffs, especially in December, drove equities revenues into the red while growing uncertainty around geopolitical and global trade tensions hit FICC.

Deutsche Bank AG which has been the strongest competitor to the U.S. groups but faced considerable pressure over the past year, managed to keep its sixth place in the global ranking by overall investment banking revenues. The restructuring of its investment bank Deutsche launched in April 2018 and completed at year-end has born fruit. The group which downsized primarily its equity business to focus on profitable fixed-income products is now tied with JPMorgan for the first place in credit while keeping its third rank in securitization.

READ: Weak Q1 forebodes tough market year for global investment banks

European peer Credit Suisse Group AG which also resized its investment bank in 2018, bowed to the market turbulence amid remaining issues at its trading unit, and dropped to eighth place. In 2017, Credit Suisse was tied for the seventh spot with U.K.-based group Barclays PLC.

Barclays, which again ranked seventh in the 2018 league table, was also one of the strongest performers in terms of year-over-year revenue growth in equities trading and overall investment banking services.

The other top performer was Goldman Sachs, which also was one of the two best-performing banks in the fixed-income, currencies, and commodities trading revenue segment.

Swiss group UBS Group AG was the second top performer in year-over-year FICC revenues.

Read our previous coverage about the full-year 2017 and 2018 half-year investment banking league table rankings. Click here to set alerts for future Data Dispatch articles. |

Coalition is owned by CRISIL. S&P Global Market Intelligence and CRISIL are owned by S&P Global Inc.