Asia-Pacific banks' aggregate bond issuance in September surged to the highest monthly level so far in 2021, driven primarily by top Japanese lenders taking advantage of low borrowing costs.

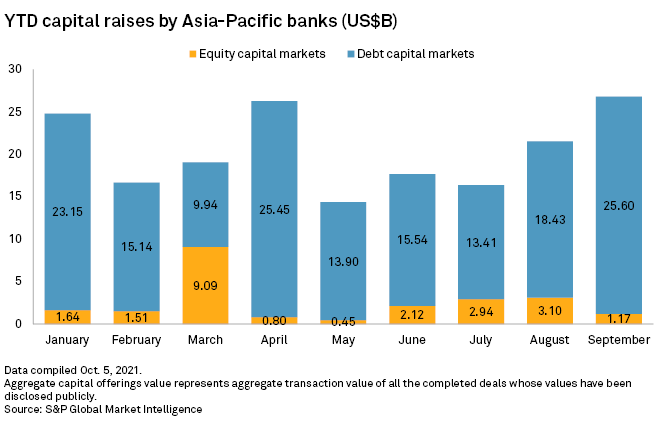

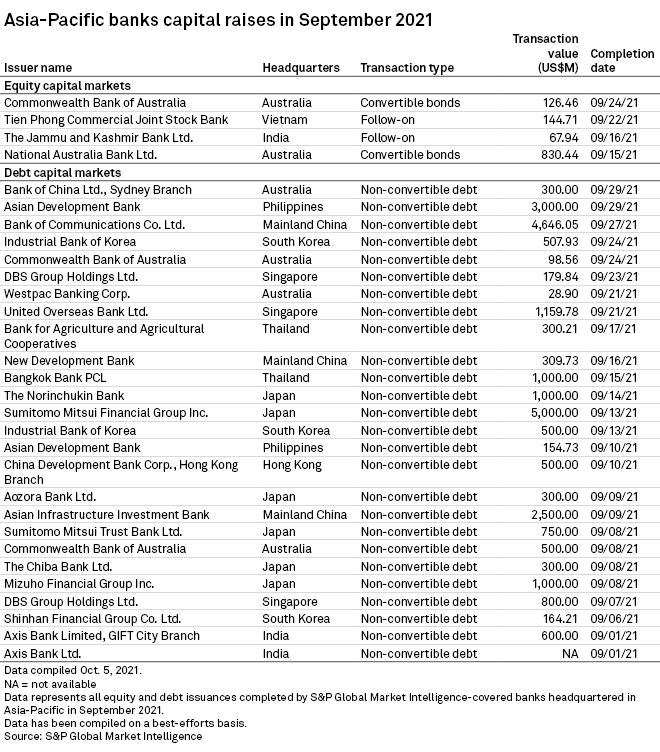

Banks in Asia-Pacific raised $25.60 billion in bonds in September, beating the previous monthly high of $25.45 billion in April, according to data compiled by S&P Global Market Intelligence. Japanese banks, including megabanks Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc., raised about $8.35 billion in debt capital, or 33% of the region's total.

"It is sure that the interest rates [in the U.S.] have entered a phase of rising," said Hajime Takata, executive economist at Japanese brokerage Okasan Securities Co., adding that Japanese banks are preparing "for the higher rates" by issuing bonds now.

The surge in debt-raising activity came as analysts expect a gradual increase in borrowing costs amid a potential tightening of the U.S. monetary policy. In its Sept. 22 meeting, the U.S. Federal Reserve said it could start to reduce its $120 billion in monthly asset purchases as soon as early November. The Fed's statement also showed that nine of 18 officials expect to raise interest rates by the end of 2022, compared to just seven officials anticipating such a move in June.

Hiroki Tsuji, senior credit analyst at Mizuho Securities Co., suggested that the increased activity of Japanese banks is seasonal in nature. Japanese banks tend to raise more funds in July and September, avoiding the summer break in August, said Tsuji.

He also said the two megabanks' issuances are not for regulatory purposes as they have already met the minimum total loss-absorbing capacity, or TLAC, of 18% of risk-weighted assets ahead of the March 2022 deadline.

In addition to Japanese megabanks, policy banks and institutions in mainland China and Southeast Asia were active in the bond market, the data shows.

China's Bank of Communications Co. Ltd. raised $4.65 billion from the market by issuing Tier 2 bonds, while Asian Development Bank and Asian Infrastructure Investment Bank raised $3.15 billion and $2.5 billion in their debt issues, respectively.

Also in September, Singapore's United Overseas Bank Ltd. and Thailand's Bangkok Bank PCL closed $1.16 billion and $1 billion of bond issues, respectively.