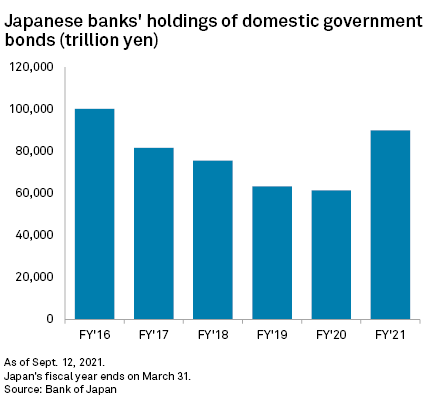

Japanese banks’ holdings of domestic government bonds could increase for the second straight year following the recent hawkish turn of the U.S. Federal Reserve and continued growth of yen deposits.

Some lenders in the world’s third-largest economy started stocking up on 20-year Japanese government bonds, or JGBs, as the yield rose past 0.41% in late August, analysts said. That was around the time when U.S. Federal Reserve Chair Jerome Powell said the taper goal has been met for inflation but cautioned that shouldn’t be read as a signal to the timing of a federal funds rate liftoff.

Banks in Japan have long been holding more than half of their investment securities in JGBs. However, the recent purchase of long-dated JGBs signaled a shift from the April-June quarter, when major Japanese banks such as Mitsubishi UFJ Financial Group Inc., or MUFG, and Concordia Financial Group Ltd. said they would allocate more cash to U.S. Treasurys as well as other higher yielding assets overseas. They said higher U.S. bond yields could boost their otherwise sluggish earnings growth amid chronically low domestic interest rates, and the Fed at that time was not perceived to be in a rush to raise interest rates.

“I’m sure that U.S. interest rates are in the direction of rising,” said Takahide Kiuchi, executive economist at Nomura Research Institute. The analyst added that Japanese banks will flee to yen bonds as a safer investment as they’re very conservative and will avoid the risk of holding U.S. Treasurys.

Despite a brief pivot toward U.S. Treasurys in the end-June quarter, banks in Japan have been putting more of their growing deposits to JGBs than to U.S. Treasurys since the fiscal year started April 2020, when their aggregate holdings of JGBs rose for the first time in at last four years. It was primarily driven by the government’s pandemic relief program, which allows banks to get interest-free loans from the central bank by offering JGBs as collateral.

"We have to invest the vastly growing deposit into somewhere," an MUFG spokesperson said. "Now may be the time to take a wait-and-see stance toward the Treasurys."

Analysts added that Japanese banks are likely to allocate a smaller portion of their excess cash to U.S. Treasurys if the 10-year yield rises above 1.5%. The yield is currently around 1.3%.

As of end-July, all licensed banks in Japan were holding ¥889.433 trillion of JGBs, or 59% of all investment securities on their books, according to the Bank of Japan. It did not say how many U.S. Treasurys these banks were holding.

Growing excess cash

The increase in domestic fixed-income assets of Japanese banks also reflects ballooning deposits during the pandemic as companies and individuals sought to rein in spending and borrowing.

Aggregate deposits and certificates of deposits at Japanese banks climbed 12.9% to ¥834.0 trillion as of end-June from ¥738.6 trillion as of end-March 2020, outpacing a 5.3% increase in lending to ¥501.2 trillion from ¥475.6 trillion during the same period.

“It’s hard to think the gap [between deposit and lending] will shrink” amid the uncertain prospects for the economic recovery, said Koichi Niwa, an analyst at Citigroup Global Markets Japan Inc.

The Japanese economy is forecast to grow 2.5% for 2021, lower than a projected 6.3% growth for the U.S. and a 6.1% expansion for the world, according to Japan Research Institute. The Japanese government’s negative interest rate policy keeps its 10-year bond yield at around 0.03%, below the 1.32% of 10-year U.S. Treasury yields.

Between end-March 2020 and end-June 2021, banks’ holdings of domestic fixed-income assets, which include corporate bonds, rose 48.6%, according to the Bank of Japan. That was much higher than a 2.7% increase of holdings of foreign securities for the same period.

Analysts noted that to invest in U.S. Treasurys, Japanese banks need to raise dollar-denominated funds from U.S. banks or by converting yen into dollar, making it costlier and riskier than yen bond purchases.

In the end-June quarter, Japan’s average monthly holdings of U.S. Treasurys rose to US$1.273 trillion from US$1.258 trillion in the previous quarter, according to U.S. data on foreign holdings of Treasury securities. Japan is the biggest foreign holder of Treasury securities, followed by China.

Yasunari Ueno, chief market economist at Mizuho Securities Co., said JGBs are the core investments of banks as the lenders are a yen-based business and need to offer a portion of such bonds to the Bank of Japan as collateral under the relief program.

As of Sept. 14, US$1 was equivalent to ¥109.67.