Japanese banks, the largest investors in CLOs outside the U.S., could return to the US$1 trillion market amid a resurgence of supply and rising expectations of an earlier-than-expected liftoff of the federal funds rate.

CLOs are floating-rate overseas securitized products backed by multiple loans to borrowers with high leverage and low creditworthiness. Lenders in the world's third-largest economy are likely to buy more CLOs when the Federal Reserve raises interest rates,

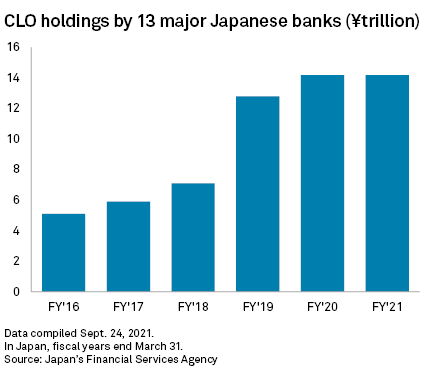

This follows nearly two years of relative inactivity. The combined holdings of CLOs by 13 Japanese lenders has been unchanged at ¥14.2 trillion since March 2020, according to Japan's Financial Services Agency.

"There are fewer CLO skeptics now than there were before the pandemic," said Stephen Anderberg, managing director of structured finance ratings at S&P Global Ratings. In 2021, the issue volume of new CLOs has exceeded expectations and new investors have entered the space, partly due to the asset class coming through the pandemic relatively unscathed, Anderberg said.

"Investors continue to search for yield and relative value. [AAA-rated CLOs]

Surging CLO issuances

New CLO issuances in the U.S. for the first eight months of 2021 more than doubled year over year to $110 billion, nearly 80% of the estimated full-year sale of $140 billion, according to Ratings.

The onset of the pandemic and related economic shutdowns in March of 2020 significantly affected companies in certain sectors that issue the loans backing U.S. CLO transactions. As a result, there was a steep drop in revenue for companies in these sectors, prompting concerns about the impact on the loans these companies had issued, many of which are held within CLO transactions, Anderberg said.

"Companies in some sectors faced the prospect of a second quarter with zero revenue. Given this, there were concerns about the impact on how CLO transactions would perform," he added.

Despite investors' potential return to CLOs, they are not likely to be a major asset class in banks' portfolios, which are mostly made up of sovereign bonds, such as Japan government bonds and U.S. Treasurys that are extremely safe with low yields.

Japanese banks for decades have been trying to balance the need to improve their investment returns and their relatively low-risk appetite, while their domestic operations have been hit by chronically low interest rates and weak loan growth. As the CLO market emerges from the pandemic without massive downgrades, major CLO investors such as The Norinchukin Bank and Japan Post Bank Co. Ltd. could stage a comeback.

"For [Japanese banks], yen bonds come first to invest in, but they're also looking at the timing of putting money to higher-yielding securities like CLOs," said Makoto Kikuchi, CEO of Myojo Asset Management.

The U.S. central bank expressed a clearer intention at its Sept. 20 policy meeting to reduce its monthly bond purchases soon, signaling that interest rate increases may follow more quickly than expected, with nine of 18 U.S. central bank policymakers projecting borrowing costs will need to rise in 2022.

A rise in the U.S. interest rates would raise the yields of CLOs, making the floating product more attractive to investors who seek a higher return.

Japanese buyers returning

Norinchukin Bank, the largest CLO holder in Japan and one of the world's largest buyers of the securities, had trimmed its outstanding CLO assets to ¥5.3 trillion as of June following six straight quarters of declines from ¥8 trillion as of December 2019. The latest CLO amount made up 9% of its total assets of ¥58.6 trillion, which include bonds, equities and credit products.

However, despite the decline in the bank's outstanding CLO assets, such securities remain one of the bank's most important credit products, a spokesperson for the bank said. "We have no option to stay away from CLO investments, the spokesperson added.

"Given a high return from CLOs, [Norinchukin Bank] will probably turn to CLOs after taking a break as they can't seek anything profitable at home,” said Yasuyuki Kuratsu, CEO of Research and Pricing Technology, an independent think tank in Japan.

Kuratsu, who has been involved in various operations at U.S. and Japanese banks for more than 20 years, including the sale of CLOs, added that he expects the Japanese lender to return to investing in CLOs when U.S. interest rates rise, "increasing the default risk and risk premium" of the credit product.

The Japanese agricultural bank increased its CLO assets to around ¥8 trillion in June 2019 from ¥5.7 trillion in September 2018, during which the three-month U.S. Treasury bills climbed to 2.30% from 2.09%. That is far above the 0.03% as of Sept. 24.

At Japan Post Bank, CLO holdings grew to ¥2.14 trillion in June from ¥2.03 trillion three months prior, representing about 1.5% of its total assets of ¥43.66 trillion. "We'll continue to invest in [CLOs] cautiously as we seek to secure a stable income [from them]," a bank spokesman said, declining to elaborate further.

Ratings believes that large Japanese banks will continue to find the CLO asset class appealing in the long term, Anderberg said, adding that short-term demand from Japanese banks may be driven by CLO tranche spreads — the difference between the three-month Libor and the yields of CLOs — and the cost of swapping U.S. dollars or euros into Japanese yen.