Japanese megabanks' ability to absorb shocks from financial and economic stress is set to be hit further by a weakening yen and rising global interest rates.

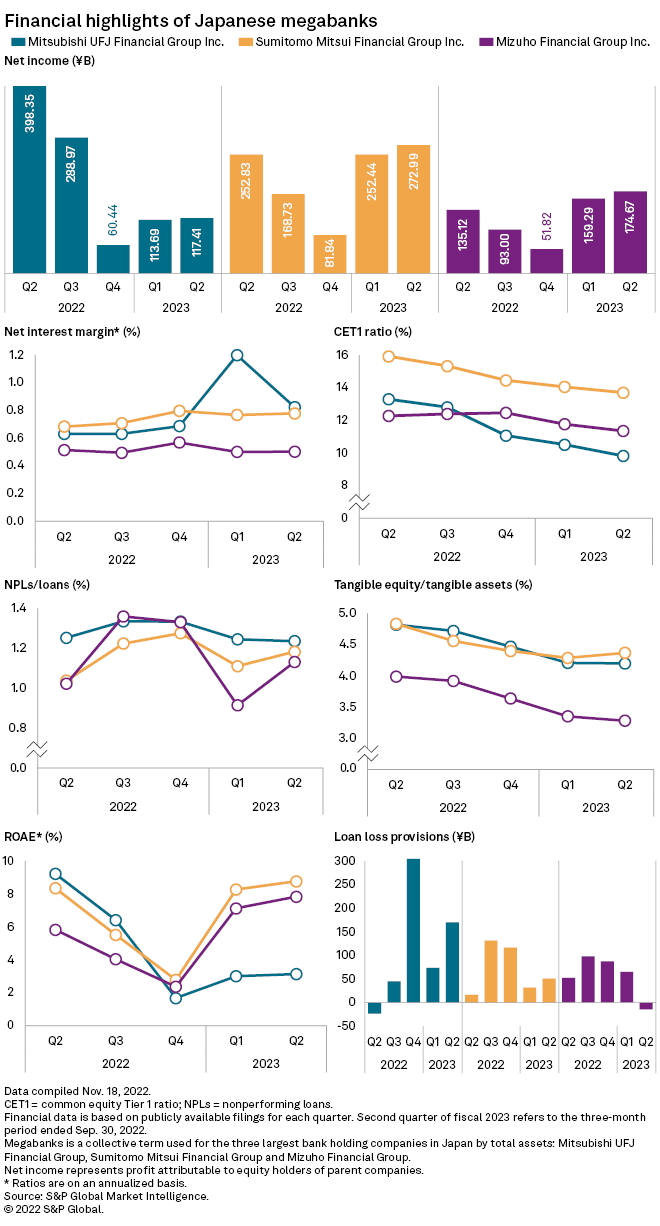

All three of Japan's megabanks have reported declining common equity Tier 1, or CET1, ratios for the past two fiscal quarters. As of Sept. 30, the CET1 ratios of both Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. fell to their lowest levels since 2017. Mitsubishi UFJ Financial Group Inc., which has the biggest overseas loan book among the trio, saw its core capital ratio fall to the lowest level since Japanese banks were required to disclose the metric under the Basel III framework in 2013.

While the banks' CET1 ratios are still above the regulatory minimum of 4.5%, the downtrend of the ratio will likely force the megabanks to replenish their core capital more quickly or offload assets that are deemed riskier, such as unsecured or distressed loans, analysts said.

"The capital adequacy will likely be hard to enhance," Toyoki Sameshima, a senior analyst at SBI Securities Co., adding that all the banks maintain a "cautious stance" on the outlook for markets.

Japanese banks have become more prone to external market volatility as they expand overseas to seek higher growth to mitigate the impact from ultralow interest rates and a slowing loan market at home.

A bank's CET1 ratio indicates how well it can withstand stress. It measures the proportion of most-liquid capital that banks hold against their risk-weighted assets, in which the value of their loan portfolios and other assets such as bonds and stocks are adjusted for credit and market risks. An increase in risk-weighted assets pushes down the CET1 ratio.

Higher risk exposure

As of Sept. 30, risk-weighted assets at Mitsubishi UFJ Financial grew 5.8% to ¥132.159 trillion from March 31. Over the same period, Sumitomo Mitsui Financial's risk-weighted assets rose 7.8% to ¥77.971 trillion, while Mizuho Financial's increased 10.2% to ¥71.337 trillion, the banks said. The yen fell 19.1% to ¥144.69 against the dollar during the same period, according S&P Global Market Intelligence data.

The risk-weighted assets of the megabanks, which are expected to generate around 30% to 50% of their operating profit outside of Japan,

Meanwhile, the risk weights on investment securities rise as higher global interest rates hit bond prices and recessionary pressures weigh on many stock markets in the world.

"Chances are high that the CET1 [ratio] at the banks will be on a downward trend," given that the U.S. interest rates could continue to dampen bonds and stocks, Takahide Kiuchi, executive economist at Nomura Research Institute.

Masahiro Kihara, CEO of Mizuho Financial, flagged the risk to the bank's overseas investments at a Nov. 14 press conference. "We require attention to the overseas markets as the U.S. and Japanese capital markets have slumped. The prospects [for the market] will remain dim," Kihara said.

The fall of ¥1 against the U.S. dollar would push Mizuho Financial's CET1 ratio down by 1 basis point, a spokesman for the company said.

As of Nov. 24, US$1 was equivalent to ¥138.47.