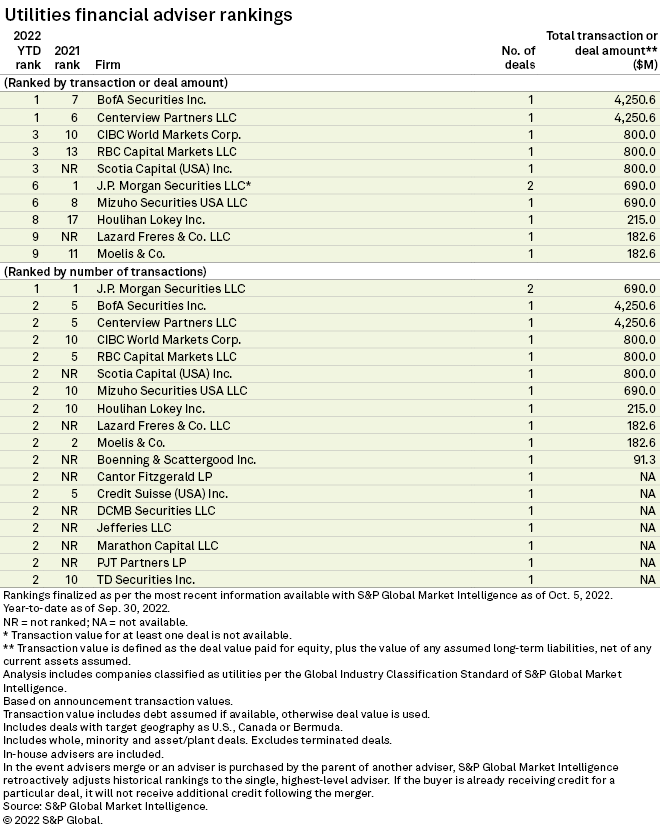

During another quiet quarter for utility deals, J.P. Morgan Securities LLC moved ahead of competing financial advisers by number of transactions, according to S&P Global Market Intelligence data.

Number of transactions

J.P. Morgan ranked first in number of transactions for full year 2021 and now again leads its peers after working on two deals in the utility sector through the end of the third quarter of 2022.

During the three-month period ended Sept. 30, J.P. Morgan added credit for advising MMR Group Inc. on its sale of the SunZia transmission project to Pattern Energy Group LP. Financial terms for this transaction were not disclosed.

The other deal credit came from an earlier announced seller-side advisory role in Dominion Energy Inc.'s sale of its West Virginia natural gas utility Hope Gas Inc. to an infrastructure fund controlled by Ullico Inc., an insurance and investment products provider.

Both deals closed during the third quarter.

Deal value

BofA Securities Inc. and Centerview Partners LLC remained atop the utility deal value rankings, despite not taking any additional advisory work in the utility sector in the third quarter.

Their deal credit in the sector, valued at $4.25 billion each, came from Infrastructure Investments Fund's proposal, announced in February, to take South Jersey Industries Inc. private. BofA Securities is advising the seller and Centerview Partners is advising the buyer on the deal, which has an enterprise value of roughly $8.1 billion.

The transaction is expected to close in the fourth quarter.

Legal rankings

Gibson Dunn & Crutcher LLP and Skadden Arps Slate Meagher & Flom LLP ranked first among utility M&A legal advisers in deal value, at $4.25 billion each, representing the seller and buyer, respectively, in the South Jersey Industries deal. Latham & Watkins LLP ranked third in deal value at $800 million but led in number of transactions with three.

* Download a template to review M&A and IPO transactions for a selected sector.

* Review Transaction League Tables on S&P Capital IQ Pro.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.