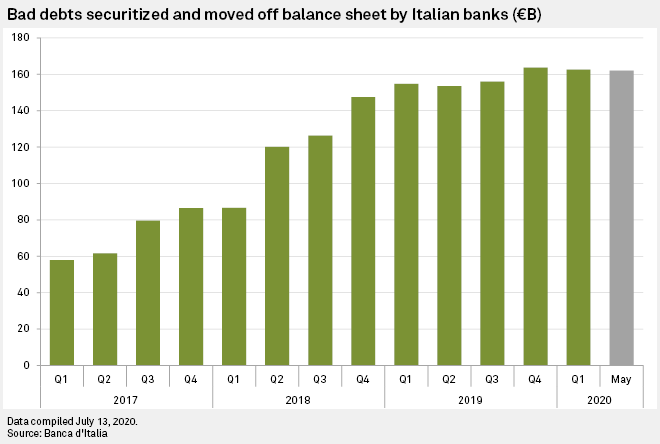

Despite the pandemic, Italian banks have continued to reduce their bad loans through a mixture of portfolio sales and securitizations. Analysts welcome these steps to bring bad debts incurred during the last credit cycle down to more manageable levels, but the true test for Italian banks' balance sheets could come when loan repayment holidays and government support packages for companies hit hard by the crisis inevitably come to an end. Once these safeguards are removed, Italian banks could be faced with a new wave of nonperforming loans.

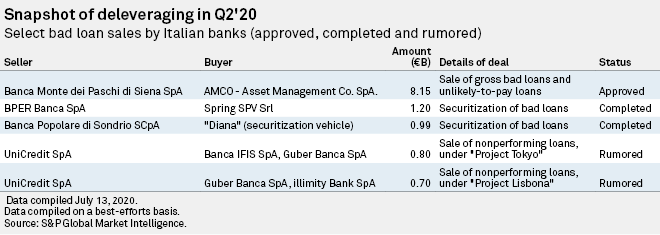

In June, Banca Monte dei Paschi di Siena SpA agreed to off-load €8.15 billion of soured loans to Italian state asset manager AMCO - Asset Management Co. SpA, while BPER Banca SpA wrapped up the securitization of €1.20 billion of bad loans, while numerous smaller deals were announced during the second quarter. Banca Popolare di Sondrio completed the securitization of around €990 million of bad loans, dubbed Project Diana, in the second quarter, while UniCredit SpA is reported to be in talks to sell €1.50 billion of bad loans, in a deal that could close as early as the end of July.

These recent de-risking efforts should relieve pressure on Italian banks' ratings, for BPER and Banca Popolare di Sondrio in particular, Fitch Ratings said in a July 8 note.

"The disposals should reduce both banks' residual NPL exposures closer to the sector average for Italian domestic banks, which was about 8% at end-2019," the note said.

In the case of Monte dei Paschi, the loan sale removes a "big source of uncertainty" about the future of the bank, according to Marco Troiano, executive director, deputy head of financial institutions ratings at Scope Ratings.

"For the larger banks, asset quality position has not been critical for some time, so this is perhaps less relevant for a credit standpoint than it was, say, in 2016/2017. But the deleveraging signals management commitment to keep the balance sheet clean, which is a good sign," he said in an email.

Bad loans incoming

To an extent, this progress is "yesterday's story," Troiano said.

"The market is obviously focused on how the COVID crisis will impact asset quality going forward. There are close to €286 billion of loans currently under some moratoria, and that could, at least in part, become nonperforming once the moratoria expire," he said.

Near the beginning of the pandemic, most of Italy's major lenders said that they would grant struggling borrowers a moratorium on their debts, a move that would ensure that they remained "performing" rather than going into default.

Nicola Nobile, lead economist at Oxford Economics, said that there could be a wave of new NPLs on the horizon, but added that "the magnitude of this problem is of course difficult to assess at this stage."

Arnaud Journois, vice president, global financial institutions, DBRS Morningstar, sees fresh threats to Italian banks' balance sheets stemming from the pandemic.

"We believe the wide scale of economic and market disruption resulting from the COVID-19 crisis will impact Italian banks' asset quality. We expect new NPLs to appear on the banks' balance sheets from 2021 in connection with the end of the moratorium programs as well as the potential rise in unemployment levels and corporate defaults," he said in an emailed statement.

Barbara Casu Lukac, director of the Centre for Banking Research at Cass Business School, also sees an uptick in NPLs due to the pandemic.

"The crisis is generating a lot of uncertainty as it has hit Italian firms very hard. I would expect an increase in NPLs in the medium term, as the economy is struggling. These NPLs might not materialize for a few months due to repayment holidays and other special schemes. However, these schemes and government support will come to an end," she said.

Lending to risky sectors

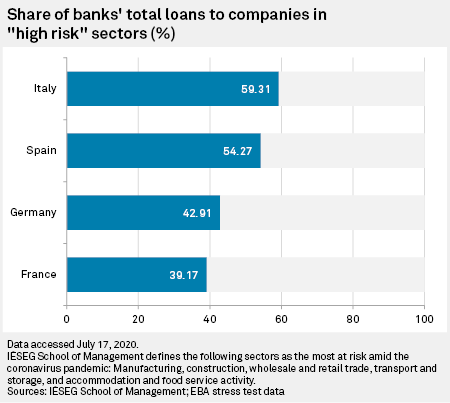

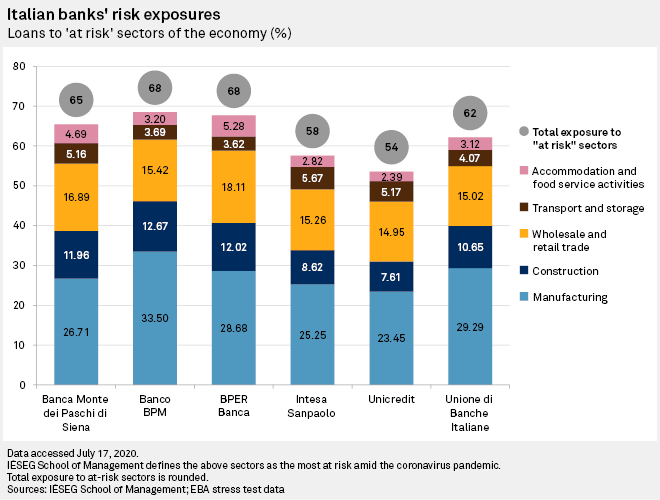

Italian banks have a particularly high exposure to sectors of the economy deemed to be most at risk thanks to the pandemic, according to a recent study by Eric Dor, director of economic studies at the IESEG School of Management in Lille, France.

Some 59.31% of Italian bank loans are to manufacturing, construction, wholesale and retail trade, transport and storage, and accommodation and food services, according to the study, which is based on the European Banking Authority's stress tests.

Out of Italy's major banks, Banco BPM SpA and BPER Banca SpA had the highest exposures to these "at risk" segments, at 68% of outstanding loans each.

Just because Italian banks lend heavily to these sectors, that does not automatically mean that they will see a surge in defaults, according to Elena Carletti, professor of finance at Bocconi University in Milan.

"These sectors are important to the Italian economy, and the government will try to support them," she said in an interview. "This is particularly true of tourism. The government will not allow it to just die."

Government financial support for companies in some of these vulnerable yet critical sectors would be good news for banks, as they would mitigate the risk of defaults, she said.

Italian Prime Minister Giuseppe Conte said earlier in July that the government was considering a package of incentives for the tourism and automotive sectors.

For Carletti, it is simply too early to make predictions about what kind of influx of NPLs Italian banks can expect.

"There are still many open questions about NPLs," she said.