Investors are turning away from the technology stocks that fueled a decadelong surge in equities as a rise in borrowing costs and recovering U.S. economy encourages a shift from the dominant growth trading strategy into value stocks.

The S&P 500 Value index — made up of the top 100 S&P 500 stocks deemed to be cheapest as per their price-to-book value, earnings-to-price and sales-to-price ratios — has returned 8.6% in 2021 as of March 8, beating the 2.0% gain for the broader S&P 500 index.

By contrast, the S&P 500 Growth index, led by the tech giants Apple Inc., Microsoft Corp., Amazon.com Inc., Facebook Inc. and Alphabet Inc., has declined 3.8% over the same period. The index is composed of S&P 500 stocks that achieve the highest growth in sales and enjoy a high ratio of earnings change to price.

The turn-around in investor appetite is stark. In the wake of the financial crisis of 2008-2009, the low-interest-rate environment created by central banks encouraged tech companies to use debt to drive growth. This business model of relentless investment to grow scale and eventually deliver returns attracted investors despite the companies running losses for years. Companies such as Amazon and Facebook eventually proved they could deliver profits.

But with the yield on 10-year Treasurys in 2021 rising from 0.94% to 1.59% as of March 8 — suggesting borrowing costs are on the rise — investors are now looking to companies and sectors that offer better immediate value.

"Investors now seem a little wary of 'jam tomorrow' growth stocks and seem to be preferring 'jam today' companies," said Russ Mould, investment director at AJ Bell, noting that companies that were hit by the pandemic offer the best short-term recovery potential.

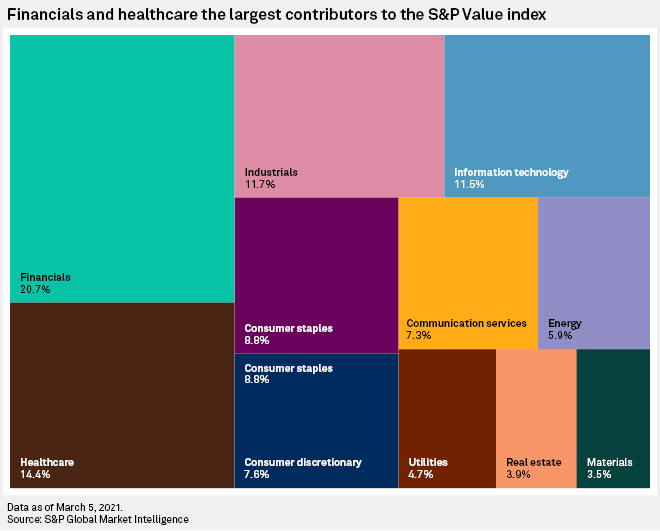

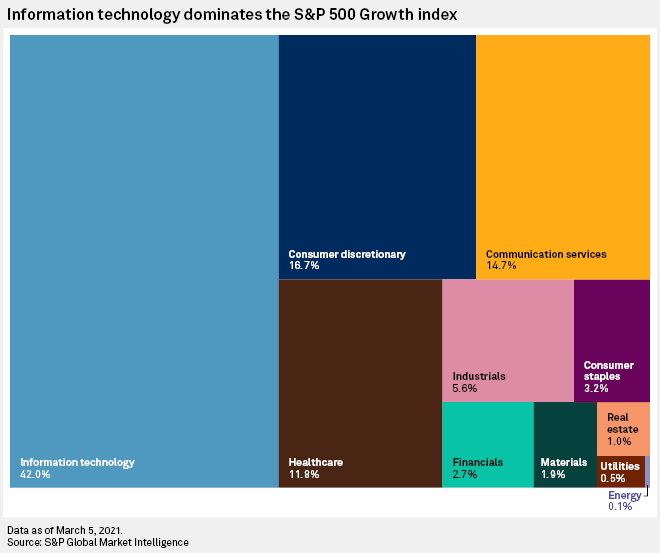

The S&P 500 Growth index, heavily weighted to the information technology sector, followed by consumer discretionary and communication services, delivered an annualized return of 15.8% in the decade ended March 8. By contrast, the value index — geared toward financials, healthcare and industrials stocks — lagged at 10.9%, meaning value investors would have been better off following the broader S&P 500, which returned 13.6% over the same period.

|

The long-term underperformance of value sectors is now another attraction for investors as economic growth recovers.

"These shares have generally done less well not just for the past year but the past decade, so they could just be offering faster growth at a much lower valuation," Mould said.

Reversal for growth stocks

The decline in fortunes for growth stocks is exemplified by Tesla Inc. The electric car manufacturer has become the seventh-largest company on the S&P 500 with a market cap of $540.4 billion as of March 8, despite only breaking into profit in fiscal 2020.

The extraordinary investor backing in the face of such a relatively moderate financial performance means the carmaker has a current price-to-book value — a key measure of market valuation — of 24.3x as of March 8. By contrast, financial companies such as Warren Buffett's Berkshire Hathaway Inc. and JPMorgan Chase & Co. — the two-largest constituents of the S&P 500 Value index, which sit either side of Tesla in the market cap rankings — have price-to-book values of just 1.35x and 1.87x, respectively.

But fortunes are changing. Tesla's share price has slumped 30.6% as of March 8 since the peak of $883.09 on Jan. 26 as a rise in Treasury yields warns of higher borrowing costs for companies that burn through cash. The share price of Berkshire Hathaway and J.P. Morgan have risen by 11.1% and 20.3%, respectively, in 2021 so far.

"The driver of the latest equity market rotation was probably the rise in government bond yields, which affects some of these sectors more than others," Thomas Matthews, markets economist at consultancy Capital Economics, wrote in a March 4 research note. "We doubt that the rise in real yields will continue. But even if we're right about that, we think the equity market rotation will continue as the global economy returns to something more like normal."

The rotation back into value equities is reminiscent of the early 2000s. The tech bubble that ballooned and burst at the turn of the millennium was followed by a rotation into value stocks that lasted from 2004 until 2008 when the financials sector was devastated by the financial crisis.

While the tech bubble has not popped this time around, the stretched valuations of tech stocks are encouraging investors to move elsewhere.

"Despite the nascent outperformance of value names, they still remain relatively cheap," economists at BCA Research wrote in a March 5 research note, adding that the valuation gap between value stocks and growth stocks is now larger than "the height of the dotcom bubble."

But the longer-term prospects for growth stocks, particularly technology, are good assuming inflation remains modest and the Federal Reserve refrains from significant rate tightening.

Value stocks should be in a good position in 2021, while tech will likely perform poorly in the first half of the year, said Joachim Klement, an analyst at investment bank Liberum. Tech, however, is poised for a comeback in the back half of 2021, Klement said.

"2022 should also be a good year for value stocks and tricky for tech stocks based on inflation headwinds," Klement said. "However, once we are past this hurdle, we expect inflation to settle down again and tech stocks to perform well over a three- to five-year horizon."